Friends of Branded!

Happy Saturday!

I’m kicking off this week’s edition of The Branded Weekend Update with quotes from two of my favorite philosophers (one real, one fiction).

From Mr. Warren Buffet, “Buy when there’s blood in the streets and sell when there’s euphoria.”

From Mr. Chance Gardner, ”Growth has its season. There are spring and summer, but there are also fall and winter. And then spring and summer again. As long as the roots are not severed, all is well, and all be well.”

I know it’s safe to assume that all readers of TBWU know about the legendary investor Warren Buffet, but I expect the Chance Gardner character and reference is a little more obscure and far less known.

Chance Gardner (or Chance “the Gardner”) is the lead character in the film Being There, a 1979 American comedy-drama about a simple-minded gardener who has never left the estate of his guardian until the guardian dies. Played by Peter Sellers, Chance is assumed by others to be a wealthy and wise genius. His origins remain a mystery, and his simple TV-informed utterances are taken by others for profundity. It’s also a favorite and often referenced movie of my older brother.

I thought about Being There and Chance Gardner as I was reading about all the challenges and most meaningful headwinds investors and companies are facing.

Thanks to an article by Forbes, I learned that the US stocks and bonds being down in the same year has happened only three times since 1928 (prior to this rare event happening again in 2022). As Forbes pointed out in the article, “anything can happen in the short run.” When stock markets fall, it’s typical for investors to look for the safety of the bond market. In 2022, however, the decline in stocks was driven, in part, because of what was happening in the fixed-income markets. The Fed’s aggressive rate increases to help combat the highest levels of inflation that we’ve seen in 40 years.

To hammer this point home further (or maybe to exhaust the point in the opinion of some of TBWU readers), 2022 was not only the first time in decades that both stocks and bonds were down in the same year, but it’s the first time in history that stocks and bonds were each down double-digits in the same year. The US stock market fell more than 18% while the aggregate US bond market was down 13%. Ten-year Treasuries were down more than 15%, while long-term government bonds were down more than 30%. According to the article by Forbes, that factoid alone makes a good case for the argument that 2022 was one of the worst years performance-wise for traditional stock and bond portfolios EVER!

So after sharing these record-breaking and most negative stats, why the Being There and specifically “garden” references? Because we’ve seen these kinds of crises before. We saw it in 1984, 2000 and more recently in 2008. We even experienced it for a moment in 2020 as a result of Covid19.

The key point – we survived! Of course, it’s painful and stressful. It’s winter time and raising capital is harder and takes longer, but here’s the good news – there is always spring after the winter.

The opportunities are all around us, but let’s make sure we all subscribe to the KISS theory (and at Branded that stands for “Keep It Simple Schatzy”).

In the emerging tech & innovation space, it means continuing to focus on companies that are addressing and solving a problem and creating value for their customers. Does that sound simple? You’d be surprised how many companies approach Branded with a solution that’s in search of a problem, challenge or opportunity as opposed to a solution that actually addresses one and to go even further, one that is of the highest priority for operators.

Make sure the emerging company is focused and is or has proven its product-market-fit. It’s also now even more critical than ever in this environment to understand that growth at all costs is OUT and speed to profitability is IN!

CEOs, please don’t debate this issue and instead take a page out of the US Marines playbook – “improvise, adapt and overcome” and embrace this investor-driven requirement.

I’ll close this ‘top of the fold’ section with a final quote for Chance Gardner: “In a garden, things grow . . . but first, they must wither; trees have to lose their leaves in order to put forth new leaves, and to grow thicker and stronger and taller. Some trees die, but fresh saplings replace them. Gardens need a lot of care. But if you love your garden, you don’t mind working in it, and waiting. Then in the proper season you will surely see it flourish.”

Okay, we’ve got a lot more to cover below, so as always, Let’s Go!!!

MARKET COMMENTARY

Articles that caught my eye combined with some Branded commentary and insights.

I grabbed this article by Krystal Hu from Reuters not just b/c she highlighted how funding for US start-ups fell by one-third from their peak in 2021 despite record amounts of capital raised by new and existing venture funds, but b/c she also put a spotlight on the relative resiliency of angel and seed-stage deal activity.

According to the article, 2022 saw $162.6 billion closed across 769 funds, which is an annual record for capital raised and marked venture capital’s rise as an asset class for money managers. This mountain of capital is slowly making its way into private tech companies as public market performance continues to weigh on private market investor sentiment. With the IPO market scarcity limiting exit options for VC investors, we’ve seen a dramatic drop in revenue multiples from 17x a year ago to about 5.7x now for tech-darlings (the article credits BVP Nasdaq Emerging Cloud Index for this information).

But this brings me back to the resiliency of the seed-stage activity in 2022 where we saw $21 billion invested across an estimated 7,261 deals. The continued resiliency in the early-stage market will depend on the growing number of actively investing micro-funds as well as the participation of non-traditional and crossover investors.

Last week I highlighted that we’ve just experienced four consecutive quarters of declines in deal activity. That factoid is in direct conflict and competition with the record amount of capital raised in the VC community. A clash of the titans is looming, and it will be played out in 2023!

Decembers are for predictions and Januarys are for executions. I therefore appreciate and want to share this article by Walter Thompson from TechCrunch where he frames so well the new success metrics for 2023!

The article of course makes mention of the “legions of investors keeping their powder dry,” but also shared the good news that investors are also adjusting their expectations to meet the new reality which, according to Lonne Jaffe from Insight Partners, means “crisper methods for evaluation success.” I’ve been highlighting repeatedly (including in the ‘above the fold’ section in this week’s edition), the point Lonne shares that instead of chasing growth like a plant reflexively bending toward the strongest light, he says founders should prioritize more meaningful “efficiency metrics” such as (i) gross retention rates; (ii) lower CAC; (iii) average revenue per sales rep; and (iv) higher gross margins.

I share a number of the views and opinions put forward in the article including the expectation that 2023 will see a meaningful consolidation in the private markets and make this a busy year for M&A.

In the emerging tech & innovation markets, the customer wants bundled and integrated solutions. The importance of this is driven by a number of factoids, but nothing is more important to foodservice and hospitality operators than removing or at least reducing as much as possible any and all friction in their tech-stack.

Friction creates the need for incremental training and adjustments to existing workflow processes. Concerns and the obsession over friction are some of the reasons our industry is so famous for accepting “good enough” and doing it “the way we’ve always done it” as the justification as to why we’ve been lagging behind the tech advancements seen in other industries including, most notably, our brothers & sisters over in retail.

The pullback and correction has put immense pressure on all of us to do more with less. It also creates a catalyst for tweeners and mid-size platforms to come together and create incremental value and efficiencies. The largest players, who are traditionally the acquirers have their own issues to address and that includes lower stock prices that make using their own stock as a driver of acquisitions less attractive.

2023 will see a great deal of M&A activity, but it will also see interesting parties come together and find value in each other that wouldn’t have happened without this correction.

I don’t often have the opportunity to bring William Shakespeare into TBWU (and I know several high school teachers that would be surprised I’m even capable of doing so), but “misery acquaints a man with strange bedfellows,” is a quote from the play The Tempest and is where the phrase “strange bedfellows” was adapted from.

Use this unique moment to think outside the box. Think about how you can create and capture value with folks and parties you may not have seen as friends and allies, b/c you always looked at them as competitors or frenenmies. This is a wonderful moment for creative and agile thinkers. We don’t always get these moments or have these opportunities. Let’s all make the most of them right now!

Remember the film Working Girl and when our heroine Tess (played by Melanie Griffith) had her career (life) changing Trask Industries moment? She came up with the idea for Trask to acquire a radio station to create Trask Radio which would give the company a solid base in broadcasting and fend off an aggressive foreign investor.

To me, “Trask Radio” is the moment where inspiration is found in the unlikeliest of places. It’s the process of collecting data from multiple sources and coming up with an unlikely, but still provocative solution.

That kind of stuff only happens in the movies, right? I don’t think so!

TECHNOLOGY

Premium seating and dynamic pricing are nothing new. Well, at least not to the hotel, travel, and sporting industries. Travelers and sports fans have had the luxury of paying for better experiences for years. That said, it's no secret that restaurants are behind the bandwagon. Just a few years ago delivery was considered a perk, now it's a potential deal breaker for customer acquisition and retention. Loyalty was a nice to have, and now it's a need to have. The list goes on... As consumers evolve in this tech-forward market we have no option but to follow their course and adhere to their expectations. Millennial's and Generation Xers in particular love experiences and are willing to pay more for better. That's where Branded partner Tablz comes in.

Tablz is a 3D booking experience like no other. The table reservation platform allows prospective diners to virtually tour a restaurant and pick their table."Tablz is not a clone of our competitors that give your real estate away for free, let us help you sell 50% of those opportunities for a massive economic value," says Frazer Nagy, CEO of Tablz.

Tablz recently launched its rebrand with an exciting fresh brand mark and look. It's the culmination of an amazing year for them, filled with hundreds of new partners and over 10k happy diners. Tablz is so proud of their restaurant partners' success on the platform, and their growth as a team, and so are we. Check out their rebrand here!

Want to see Tablz in action? Check them out on Isabelle's Osteria, a contemporary Italian restaurant located in NYC!

The Access Hospitality Network is off and running!

If you're interested (and only if you're an accredited investor), please consider signing up for Branded’s Access Hospitality Network. This is our very own investment club & community that will be afforded unique and differentiated investment opportunities. Commentary shared with the Network will focus on the M&A and Capital Markets associated with this industry and this emerging alternative asset class. There are no dues or membership fees. Members of the Network will benefit from specialized publications, thought leadership, proprietary deal access, exclusive events and more!

If you’re interested in joining The Network, please click the link: Access Hospitality - powered by Branded Hospitality Ventures.

FINANCE & DEALS

Do Friendly Bears Exist?

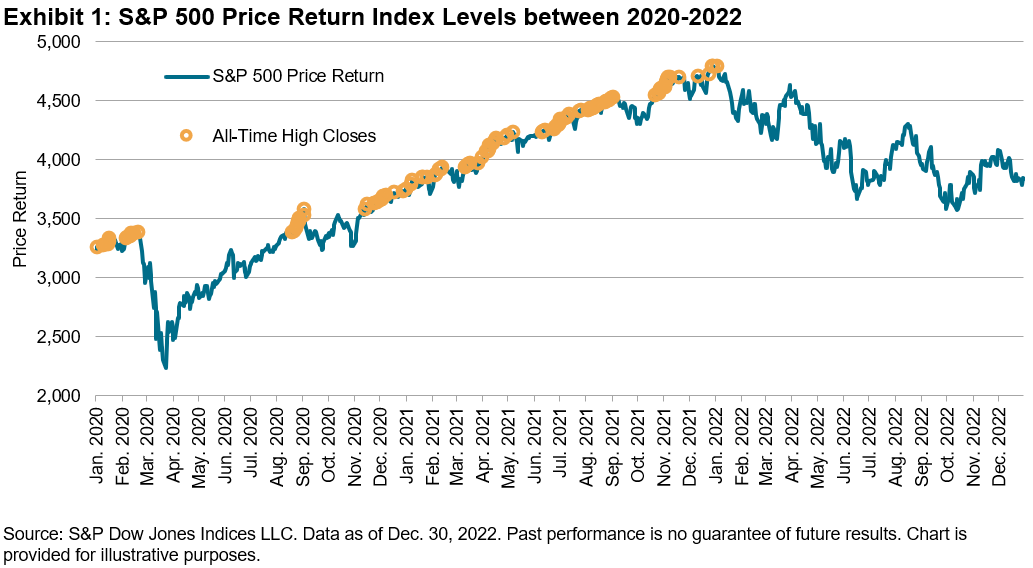

—Read the article from S&P Dow Jones Indices

On Wall Street, bear markets represent declines of at least 20% from their highs. But on Main Street, bears are anthropomorphized as friendly. Here we look at whether bears can also be “friendly” in financial markets, looking at the S&P 500®’s bear markets to assess what periods of pessimism have told us, historically, and whether there may be glimmers of hope.

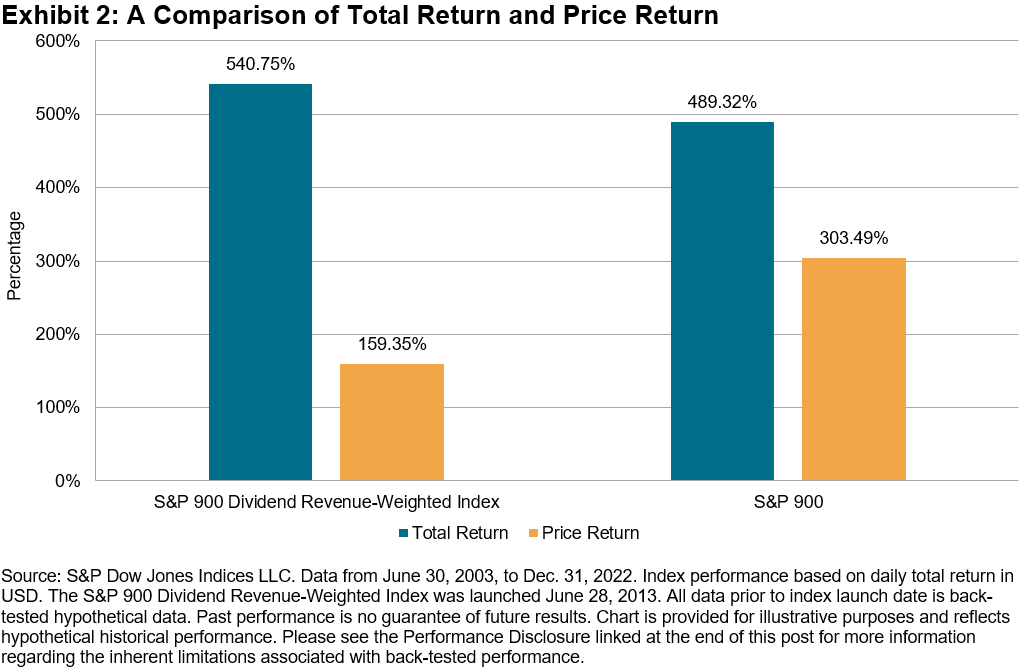

The S&P 900 Dividend Revenue-Weighted Index: A Standout Performer in a Challenging Year for Equity Markets

—Read the article from S&P Dow Jones Indices

2022 was a difficult year for equity investors as rising interest rates, increasing geopolitical risks and slowing economic growth put downward pressure on equities. However, factors such as dividend yield and value fared much better than the broader equity market due to their shorter durations. Despite this challenging economic environment, the S&P 900 Dividend Revenue-Weighted Index posted an impressive 7.57% in 2022, representing 25.39% outperformance versus its benchmark. In this blog, we will analyze this index’s methodology and examine the dividend yield and value tilts, all of which contributed to its outperformance.

Middle-market M&A players expect conditions to stabilize in 2023

—Read the article from MarketWatch

More than 80% of U.S. middle-market companies and private equity firms agree that company valuations will be stable or higher in 2023 after a year of big price adjustments, according to an annual survey by Citizens Financial Group Inc.

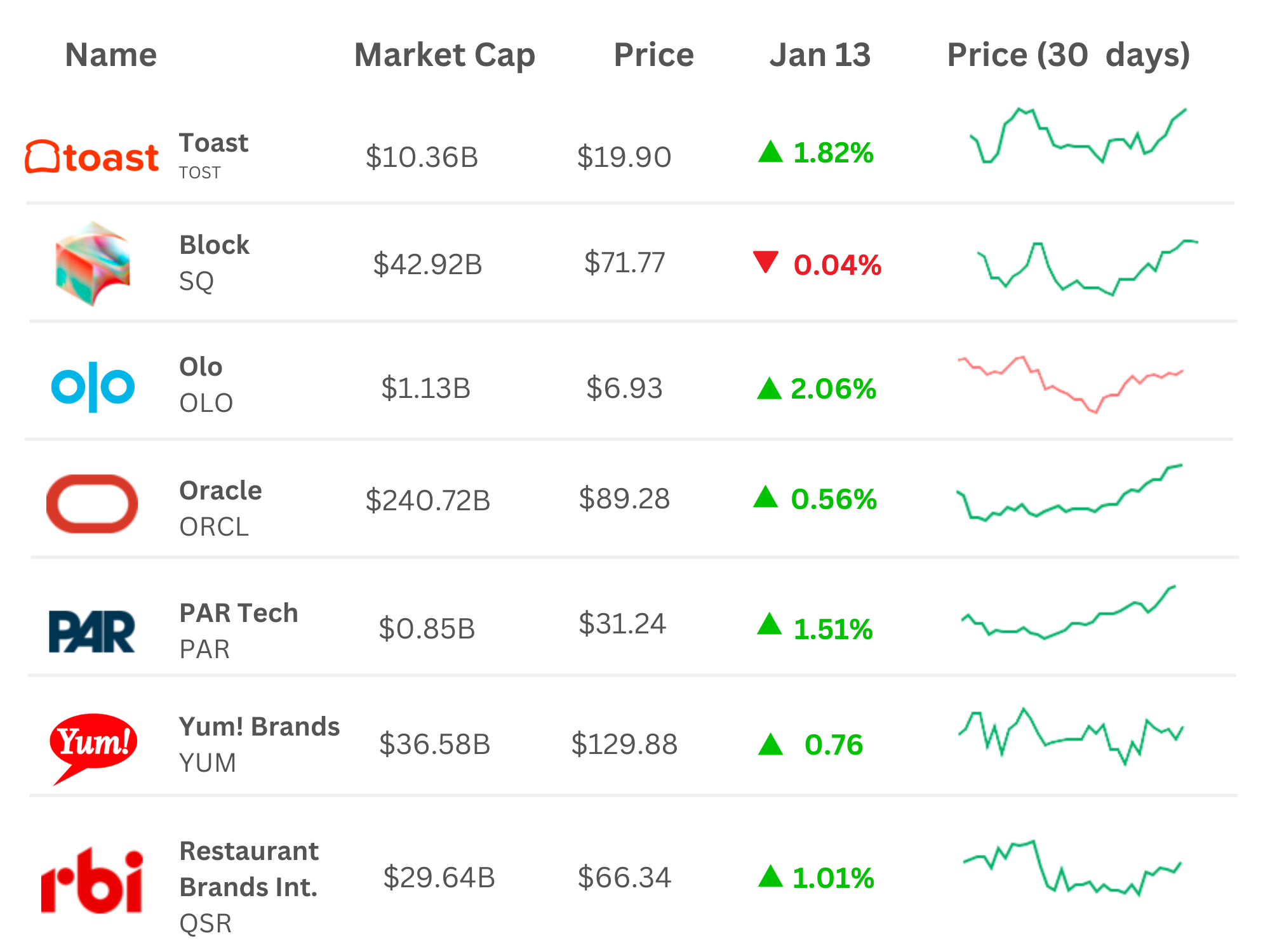

Restaurant Industry Movers in the Market

—Data as of 1/13/23

BUSINESS

Tech is no longer a nice to have, it's a need to have. For a restaurant to be successful in today’s world it must be agile and adapt quickly to changes in procedures and protocols.

Below please find a few insights from some of the largest consulting firms in the world.

PODCAST

Tuesday, January 10th- Hospitality Hangout: In the latest episode of Hospitality Hangout, Michael "Schatzy" Schatzberg “The Restaurant Guy” and Jimmy Frischling “ The Finance Guy” chat with Trevor Shimizu, co-founder and chief revenue officer of Brizo FoodMetrics. It is a data and analytics provider for the foodservice industry, analyzing 1.3 million eating and drinking establishments in Canada and the United States.

Shimizu played professional ball for a few years before getting into technology. Frischling repeats one of his favorite podcast topics and says, “That operators did not get into the restaurant industry to become data analysts and funny enough Brizo didn't start off in the data industry to be restaurant data miners. So you know we're all kind of in this together now.” He adds that the first two pilots were actually foodservice businesses that led Shimizu to become Brizo FoodMetrics specializing in food metrics and the foodservice space.

Listen to the full episode on Spotify, Google Podcast, Apple Podcasts, or Amazon Music

Are you looking for a tech solution? A new partnership? Or maybe an easy way to built your tech stack??? Check out BOOM a food service marketplace!

BOOM a food service marketplace! is a digital ratings and review platform providing best in class technology, innovation, professional services and suppliers for the entire spectrum of the hospitality industry.

Want to learn more? Click HERE or contact us at boom@brandedstrategic.com

IN THE NEWS

Hospitality Tech and F&B Innovation IN THE NEWS:

We love to highlight Food Service & Hospitality news, especially when it’s Partners & Friends making it!

- Chowly: Taco Nazo increased delivery sales by $73,000 with Google Direct Order

- PourMyBeer: Hotel Manager's Experience With PourMyBeer Technology

- Yumpingo: Experience Drivers – What do customers really care about?

- Vromo: E-book: How to Do Self Delivery Without Hiring Any Drivers

- MarginEdge: How to Reduce Restaurant Food Costs in 2023

- GoTab: Hear from GoTab CEO and Co-Founder Tim McLaughlin Live at ICR Conference

- Galley: Webinar Takeaways: A Single Source of Truth for Culinary Operations — Harvest Table Culinary

- Incentivio: Why You Need Online Ordering At Your Restaurant

- Valyant: How Chains are Rethinking Their Tech Roadmaps

And in other News…please see some of the stories that caught our attention and that we’re paying attention to. This week was loaded with headlines and news!!

- Restaurant Business: Is Tao Group Hospitality for Sale?

- TechCrunch: Nvidia unveils new AI workflows to help the retail industry with loss prevention

- Reuters: Sandwich chain Subway eyes sale

- Speech Technology: SoundHound Partners with Toast to Help Restaurants Offer Voice Ordering

The Branded team is heading to NRF in New York City from January 14-17. Retail’s Big Show is retail’s most important event. With three days of educational programing, an enormous Expo featuring the latest retail solutions, plus an Innovation Lab and Startup Zone featuring breakthrough technology, Retail’s Big Show will introduces attendees to the ideas, people and partners that will put them on the fast track to success.

We're eager to connect with old friends, make some new friends and of course boast about our partner companies. This year Branded partners Bite, Ottonomy and Picnic will be coming to the Big Apple for the show.

If you'd like to link up, email us at events@brandedstrategic.com!

MARKETING

CONGRATS! You read to the bottom and that makes you my favorite kind of reader of The Branded Weekend Update!

Now be the action taker I know you are and register for the Branded Restaurant Marketing Summit.

It’s an online event happening virtually on January 25 and 26th. You’ll be able to login anytime on either of those days and watch presentations from 32 people in our business who I believe have more than earned status as incredible thought leaders.

They donated their time to share with you marketing tactics, tips and hacks that will help you achieve your marketing goals, better faster, and easier.

And the best part is all it takes is your commitment because it’s FREE!

Seriously, like, who says no to free training from some of the most experienced and intelligent restaurant leaders in the business? It’s not you.

YOU ARE A SAY "YES" PERSON!!

Register now for free: https://www.restaurantsgrow.com/summit

That’s it for today! I wish you a wonderful weekend!

See you next week, (about the) same bat-time, same bat-channel.

It takes a village!

Jimmy Frisch

Co-Founder & Managing Partner

Branded Hospitality Ventures

jimmy@brandedstrategic.com

235 Park Ave South, 4th Fl | New York, NY 10003

Branded Hospitality Ventures ("Branded") is an investment and advisory platform at the intersection of food service, technology, innovation and capital. As experienced hospitality owners and operators, Branded brings value to its portfolio companies through investment, strategic counsel, and its deep industry expertise and connections.

Learn more about Branded here: Branded At-A-Glance_Dec 2022