Friends of Branded!

Happy Saturday and I hope everyone had a good week.

I’m NOT an investigative journalist (or even a journalist). I have the privilege of co-managing an emerging venture platform and I started writing an e-mail to my team each and every Saturday.

Thanks to the power of the “forward button” combined with some enthusiastic teammates, here we are! Over two years later we have a Saturday morning newsletter dedicated to the foodservice and hospitality industry with a heavy focus on emerging technology and innovation that will create value for the Branded "Core 4": (i) Partner Companies; (ii) Hospitality Network; (iii) Syndicate; and (iv) Strategic Connections.

I try NOT to be influenced by the main street media and as opposed to any anger that some direct at the “MSM”, I just feel they’re covering that stuff, so what value can I bring over in the land most covered by the reporting industry.

However, when a bank with over $200 billion in assets collapses, represents the biggest financial failure since 2008 and results in the FDIC stepping in and seizing the lender yesterday, it’s not possible for me to select any other topic as the focus of the “top of the fold” section.

I do feel that I need to put my own take on the collapse of SVB and that may or may not jive with what others have to say about all of this folks (so I've got that going for me, which is nice!).

First, the facts (as we know them). Silicon Valley Bank(“SVB”) had roughly $209 billion in assets and $175.4 billion in total deposits. The last bank failure of this size was Washington Mutual back in 2008. WaMu had $307 billion assets. On Wednesday this week, SVB surprised the market by announcing that it was looking to raise more than $2 billion in additional capital after suffering a $1.8 billion loss on assets. According to Mr. David Faber (love that I got Mr. Faber in TBWU...call me!), once the efforts of SVB to raise capital failed, the bank pivoted to a potential sale, however, a rapid outflow of deposits complicated the process, essentially resulted in the bank run and now the collapse of SVB.

One of the biggest questions being asked is how isolated or widespread this financial collapse is and what does it represent for the broader banking system. What we’re being told by Wall Street Analysts, is that the issues plaguing SVB are unlikely to spread to other financial institutions. The markets are at least suggesting a more concerning view as other midsize and regional banks were under pressure on Friday.

This dovetails into my cockroach theory (doesn’t everyone have a cockroach theory?). 😊

I’m a native New Yorker and have lived in the city my whole life. Back in the 1990s, it wasn’t uncommon for me to walk into my alley kitchen, turn on the light and see a single cockroach raising over the backsplash to find safety away from my effort to send this unsavory creature to its death. My point here is NOT to share that I had roaches in my apartment (or to insight any negativity that my goal was to kill them), but to simply make the following point crystal clear – there was NEVER only a single roach in the walls, drains and otherwise of my apartment. It was just the one I saw or didn’t make itself scarce before I turned the light on.

I still have the scars associated with the volatility of The Great Recession. When Bear Stearns failed, everyone thought that was going to be one and done but that was obviously not the case. Before anyone jumps all over me, the root cause of The Great Recession was the global banking system being over-leveraged and our going through a period of excessive lending, risky loans and I dare say a housing bubble and irresponsible lending associated with the US mortgage market (the loans, securities and derivatives).

In June of 2007, two large hedge funds collapsed as a result of their investments in subprime loans. In August of that same year, the losses from subprime loan investments caused a panic that froze the global lending system. In March of 2008, Bear Stearns failed and was subsequently sold to JP Morgan Chase (with some John Stockton-like assist work from the Fed who agreed to provide an emergency loan to keep Bear afloat). In September 2008, and to be specific, on Sept 15th, Lehman Brothers collapsed. On Sept 26th, WaMu collapsed. I’m going to stop here on my tour down memory lane of that time of my life (I lived it, read the books, watched the movies & documentaries and still have the occasional nightmare about that experience).

Why does this matter to Branded? SVB is (was?) known for providing financial services to tech start-ups. I want to emphasize this point further, SVB was deeply and heavily embedded in the US start-up scene and was regarded as the ONLY publicly traded bank focused on Silicon Valley and tech start-ups. According to SVB’s website, the bank did business with nearly 50% of all US Venture capital-backed start-ups and 44% of the US venture-backed tech and healthcare companies that went public last year.

According to Morgan Stanley analysts, “falling VC funding activity and elevated cash burn are idiosyncratic pressures for SIVB’s clients, driving a decline in total client funds and on-balance-sheet deposits for SIVB. That said, we have always believed that SIVB has more than enough liquidity to fund deposit outflows related to venture capital client cash burn.” To be clear, Morgan Stanley is saying SVB is the only cockroach in the kitchen. I have my concerns and I dare say doubts.

Here's the deal, unfiltered - the Federal Reserve has been raising interest rates from their record low levels in its effort to fight inflation. High interest rates reduce the appetite from investors to take on risk and this change in market dynamic weighs more heavily on technology start-ups, the primary clients of SVB. Higher interest rates and the overall pullback/correction in the tech market resulted in private funding being more expensive (as well as essentially shutting down the IPO market for emerging and growing companies). Clients of SVB started pulling money out of SVB to meet their own liquidity needs. In order for SVB to meet its clients’ withdrawals and fund these redemptions, the bank sold a $21 billion bond portfolio consisting of mostly US Treasuries. SVB’s bond portfolio was yielding an average of 1.79%, which is obviously well below the current 10-year Treasury yield of around 3.9%. SVB recognized a $1.8 billion loss as a result of the liquidation of this portfolio.

The spark that lit this flame was SVB being forced to sell its seemingly safe and primarily longer-term Treasury’s and government-back mortgage securities. The surge in SVB's deposit base from venture-backed companies led SVB's book of securities to increase from about $27 billion in Q1 2020 to around $128 billion by the end of 2021.

The ownership of a portfolio of safe assets is NOT unique to SVB. In fact, according to the Wall Street Journey, across all FDIC banks, there are about $620 billion of unrealized losses in securities portfolios as of Q4 2022. What other banks have misjudged the match between the stickiness of their deposits and the yield on their assets?

The Great Recession was the story of leverage and bad lending. How many other banks used the increase in their deposit base to reach for SAFE yielding instruments, but have now been negatively impacted by the increases in interest rates? The losses on these “safe” assets are the unintended consequence of the Federal Reserve’s need to fight inflation.

SVB might have been the largest player in the venture-backed company space, but they’re not the only player. The market is already dealing with the failure of Silvergate Capital who failed as a result of its exposure to crypto PLUS a portfolio of government debt (whose value was also negatively impacted by higher rates) and there are concerns about First Republic and Signature (both of these financial institutions had trading in their stocks halted on Friday morning). Away from the issues or concerns around the value of the SAFE assets at financial institutions, is the impact that can be caused by the flight to quality that started at the end of this work week and will continue to take place next week.

Did rising interest rates kill SVB? The challenges facing early-stage companies? Peter Thiel? To be fair, Mr. Peter Thiel was NOT the only prominent venture capitalist to instruct its portfolio companies to pull their cash from SVB, but he was one of the loudest. As Harry S. Truman famously said, “if you want a friend in Washington, get a dog” (the image below is NOT Harry S. Truman, but the quote was used in this most important movie about Wall Street). SVB has been the most prolific and important banking institution for tech start-ups for decades, but that was then and today is a new day.

Other Wall Streets heavyweights are also chiming in, and I guaranty you that whatever position they’re voicing, they’re talking their book! Hedge Fund legend Bill Ackman is calling on the US government to bail out SVB. Michael Burry, the investor that made the bets against the US housing market (made famous by The Big Short) believes “it’s possible today we found our Enron.”

Long-term readers of The Branded Weekend Update know all about our “Core 4” which I highlighted above and will include again here: (i) Partner Companies; (ii) Hospitality Network; (iii) Syndicate; and (iv) Strategic Connections. I’ve often shared (or admitted) that I also enjoy saying the “Core 4” b/c it rhymes (I’m a simple person, with simple pleasures).

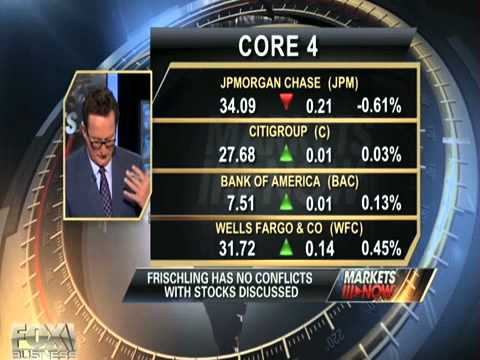

The truth is, this isn’t the first time I’ve used the expression the “Core 4.” In fact, I will admit here, for the VERY first time since launching Branded in late 2018, that I originally used this expression back on June 14th, 2012, during The Great Recession and in connection with my talking about the biggest and most important banks in the US during a segment of Fox Business News.

I used the expression “Core 4” to refer to the banks that, in partnership with the Federal Reserve, were being leaned on to help save the global financial system. I spoke specifically about JP Morgan, Citigroup, Bank of America and Wells Fargo (the “Core 4”) not only being the biggest banks in the US, but the ones that would become even bigger as there would be a flight to quality. FBN was kind enough to immortalize the “Core 4” in the graphic below.

Here's the clip: Frischling Appearance on FBN - 06.14.2012

This top-of-the-fold section was admittedly long and I’m sorry (not sorry) about that. The collapse of SVB is a big deal and an important story that is not remotely done, and the damage is neither fully known nor complete. Are there risks and landmines that we will discover as a result of the failure of SVB? Absolutely. Will there be opportunities coming out of the collapse of SVB and the flight to quality that’s expected? Absolutely!

Branded prides itself on being a builder and positive contributor to the community we feel so fortunate to be part of. We love the company we keep and the many industry players we get to work (and play) with. We feel terrible about our friends at SVB who have been supporters and allies not only to Branded, but to so many of our friends and partners.

The good news or maybe more appropriately stated, the silver lining, I expect depositors will receive all or at least the super vast majority of their deposits back. The full (or partial recovery) will take at least a little time and will also depend on the quality of the assets that will be sold as well as the other liabilities that are competing for the available capital. The timing of this cash being made available to the many emerging tech and innovation companies that banked with SVB is the pressing issue. The faster the process to liquidate and settle the affairs of SVB can be completed will prove to be of paramount importance. The only thing I can guarantee here is that it won’t be boring and it ain’t over, till it’s over.

I will be even more specific, if a clear answer isn't provided to all the uninsured depositors of SVB by Monday morning, regional banks will see depositors pulling funds and heading over to any of the "Core 4."

Okay, it was a very busy week at Branded and we’ve got more to cover. As always, let’s go!

MARKET COMMENTARY

Articles that caught my eye combined with some Branded commentary and insights.

This article, by Austin Verner, is actually just a few weeks old, but I’m breaking it out today. About 12-months ago, a friend of mine told me that the foodservice technology space was saturated and that the transformation of the industry with respect to the embracement of technology was essentially complete.

I responded that while there was certainly an explosion of new software companies that have entered the market (and many were in fact not necessarily differentiating themselves), the technology evolution and transformation is still very much in the early innings.

One of the key verticals Branded continues to be very focused on is “guest engagement.” Guest engagement, of course, means different things to different people. The goal of creating an effective guest engagement process is to win repeat business and gain customer loyalty. When I was a bartender, I admit that I might of, from time to time, occasionally, sometimes, maybe (okay…OFTEN!) complained about a customer, but let’s not kid ourselves, guests are how we prove our product, market, fit (and how we stay in business). Standing out from other venues is one barometer of the success of a restaurant, but repeat guests are even more valuable. This is where guest engagement and specifically loyalty, digital marketing and feedback are so important.

Here’s what a successful guest engagement offering will do for your venue – it will strengthen your ability to acquire guests and improve the retention rates of your guests.

The article wants you to know the importance of guest reviews & feedback. Online reviews have always mattered to restaurant venues, but in this digital age, the importance of your online footprint is critical! It takes roughly 40 positive guest reviews to counter the damage of a single negative review. In addition, only 1 in 10 HAPPY guests even leave a review. The article asks an important question, not about whether the guest found the venue online, but rather, “what do they find when they find me?” The author gives advice on how to respond to negative reviews and the importance (and value) of positive reviews.

This is where I’m pivoting from the article to putting a spotlight on Ovation - the #1 guest feedback platform for restaurants. I was speaking with my friends and partners at Ovation during our monthly call and they shared the successful performance Ovation had with a small pizza company (dba: Domino’s). Ovation and Domino’s completed a 4-month test comparing the performance of stores with similar sales, similar satisfaction levels of reviews, and were in the same cities.

The results from this 4-month test made it clear that Ovation's platform isn’t just about guest feedback, Ovation drives reviews! Domino’s used Ovation in some stores, but not in all of them. The stores that used Ovation had 4.8x more online reviews and 1.6 stars higher online reviews and drive 9.2% more revenues.

The test case with Domino’s also revealed that by using Ovation Insights, they were also able to uncover one Domino’s store was having a lot of issues with food prep consistency. Thanks to Ovation, Domino’s was able to go in and perform training to reduce complaints from 28 per week to 3 per week. Ovation also secured a 250-location chain using them for over a year in half their locations and we’ve learned thus far that Ovation locations are making 25% more than non-Ovation locations.

Finally, thanks to the collaboration with Gregorys Coffee, Ovation is launching a new phone system that will be the first company to ever give full omnichannel feedback support for restaurants.

Branded continues to believe in the foodservice and hospitality technology industry and we’re confident in the leadership and value Ovation brings to its customers. This most important vertical that we call “guest engagement” also puts a well-deserved spotlight on Ovation and we now have evidence that this operator-centric company drives reviews.

TECHNOLOGY

Earlier this week, meez announced their partnership with Gordon Food Service, the largest family-operated food distribution company in North America. If you’re unfamiliar with meez, they are a culinary operating system that centralizes recipe creation, organization, and distribution, making it easy to train and onboard staff, get accurate food costs, scale precisely, and much more. Together, meez and Gordon Food Service have launched Gordon Culinary Pro to help chefs and culinary teams create and organize recipes efficiently. Gordon Culinary Pro offers users a host of benefits that will enable them to:

· Keep recipe costs accurate, enabling better decisions

· Cut training time and costs

· Simplify recipe management and version control

· Improve consistency of execution

· Reduce food waste caused by scaling errors

· Streamline collaboration among the team and multi-unit operations

To learn more about the partnership, CLICK HERE!

FINANCE & DEALS

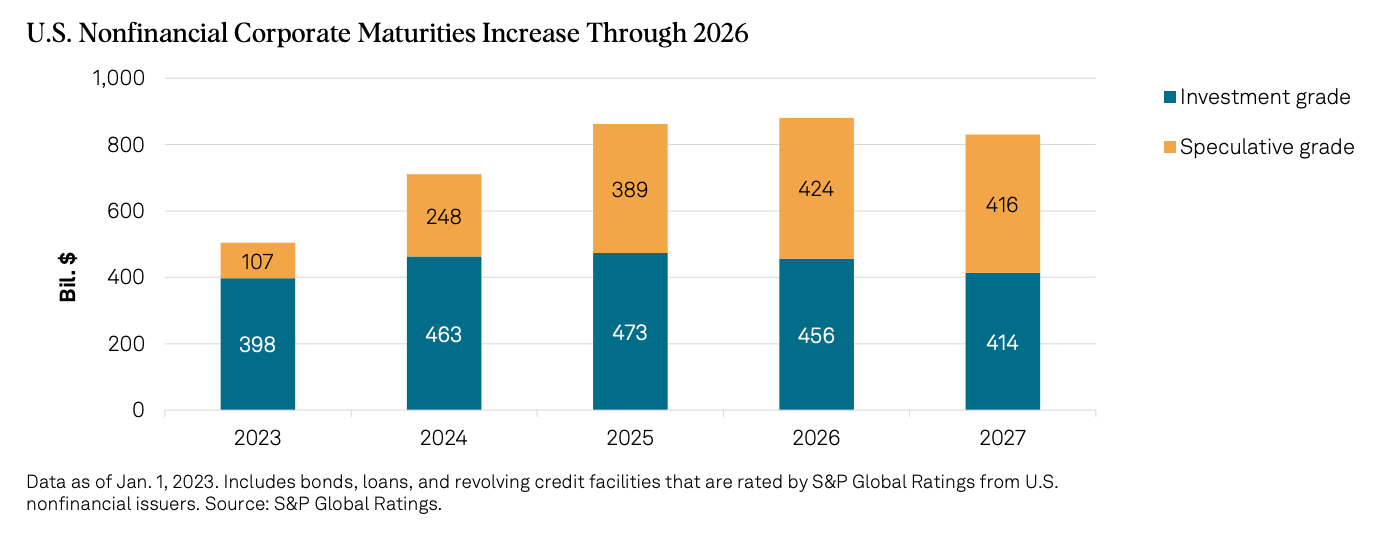

U.S. Corporate Credit Outlook 2023: Profit Pressures, Refinancing Risk

Near-term profit pressures on U.S. corporate borrowers look set to intensify, as many find it more difficult to deal with still-elevated input costs and waning demand amid the prospects of a downturn in the world’s largest economy and diminished consumer purchasing power. Benchmark borrowing costs will likely go higher still, as the Federal Reserve continues its fight against inflation.

—Read the report from S&P Global Ratings

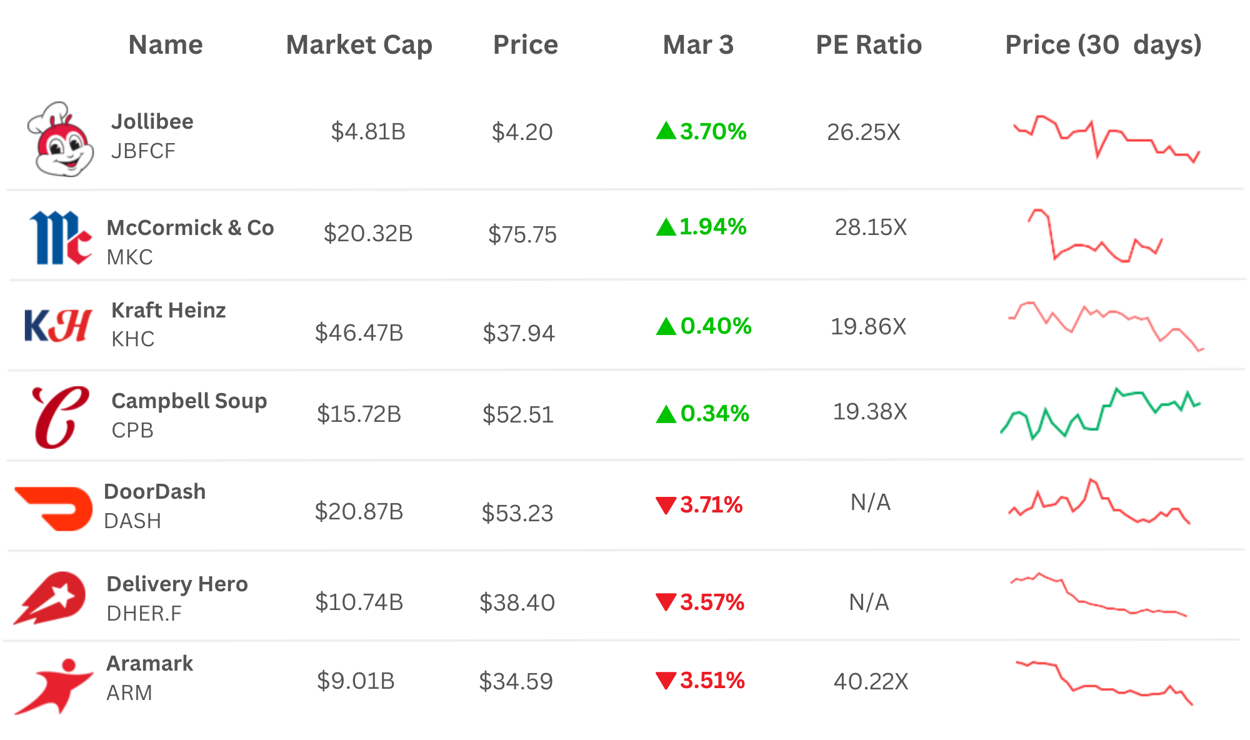

Restaurant Industry Movers in the Market

—Data as of 3/10/2023

BUSINESS

A Harmonious Group

Mutually beneficial partnerships are founded on reciprocal relationships between stakeholders. The principles of mutuality and reciprocity underscore that every stakeholder involved in a partnership derives meaningful and advantageous benefits from the collaboration, aligned with the larger shared objectives.

A partnership is built on trust, respect, and shared goals. Similar to the harmonious pact between the crows and the wolves. Just as these animals have learned to rely on each other's unique strengths, businesses must also foster mutually beneficial partnerships to achieve success. The wolves provide the strength and power needed to take down prey, while the crows lead the pack to potential prey. In turn, the wolves share their kills with the crows, providing a reliable food source.

Similarly, in business, strong partnerships are a powerful force for success. When companies work together, they can leverage each other's strengths to achieve more than they could on their own. This can lead to increased innovation, greater efficiency, and ultimately, greater profitability.

That being said, click here to learn how outsourcing and building outside relationships can provide business benefits:

- Reduced operating costs and greater return on investment (ROI)

- Shorter time to market through faster accesses to increased capacity, new technologies, specialized facilities, intellectual property (IP), and expertise

- More efficient use of critical internal resources (e.g., human and facilities)

- Avoidance of large expenditures to bring new or expanded capabilities in house as well as the cost of staffing those capabilities

- Increased velocity and flexibility in responding to rapidly changing global markets.

Source: BioPharm

PODCAST

Tuesday, March 7th- Hospitality Hangout: In the latest episode of The Hospitality Hangout, Michael "Schatzy" Schatzberg “The Restaurant Guy” and Jimmy Frischling “ The Finance Guy” chat with Jacob Jaber, Co-Founder of Philz Coffee and Consumer Investor.

Jaber talks about how he and his dad built Philz Coffee. He said that he knew how to treat people, how to make a personal cup of coffee, and how to work the business. They worked with people that knew how to create systems, processes, and organizational structures to help them open locations.

In terms of investing and advising Jaber says that he’s helped hundreds of entrepreneurs strategize, find product market fit, and build a team. He says this brings him the most joy. Jaber currently has almost twenty companies in his portfolio and they are out there looking for businesses.

Listen to the full episode on Spotify, Google Podcast, Apple Podcasts, or Amazon Music

Are you looking for a tech solution? A new partnership? Or maybe an easy way to build your tech stack??? Check out BOOM a food service marketplace!

BOOM a food service marketplace! is a digital ratings and review platform providing best in class technology, innovation, professional services and suppliers for the entire spectrum of the hospitality industry.

Want to learn more? Click HERE or contact us at boom@brandedstrategic.com

IN THE NEWS

Hospitality Tech and F&B Innovation IN THE NEWS:

We love to highlight Food Service & Hospitality news, especially when it’s Partners & Friends making it!

- Agot: America's Best Startup Employers

- Brizo: Exploring the Benefits of Big Data for Foodservice Suppliers

- Chowly: DevourGO and Chowly Team to Bring Next Gen Food Ordering to Restaurants with Easy Integration

- Ecotrak: Ecotrak Partners With Therma to Monitor and Optimize Cooling Asset Performance

- GoTab: Hospitality Sector Becomes America's Fastest-Growing Employer

- Leasecake: The MomPact Awards: Celebrating the Companies Who Make a Difference

- Meez: meez announces partnership with Gordon Food Service with launch of Gordon Culinary Pro

- Mighty Quinn's: Mighty Quinn’s Barbeque Returning to Williamsburg

And in other News…please see some of the stories that caught our attention and that we’re paying attention to. This week was loaded with headlines and news!!

- The Wall Street Journal: Salad Chain That Thought It Was a Tech Firm Looks Wilted

- Food On Demand: State of Restaurant Industry Reports $997B in Sales, Tech Adoption Up

- Inc: Sweetgreen's $364 Million IPO Brought Major Growth Plans, but Also New Challenges

- Fast Company: The World's Most Innovative Companies of 2023

MARKETING

💪 What is the one easy-to-execute marking move that you can do that will increase guest frequency for your restaurant?

Great hosts know how to bring out the best in their guests and that's exactly what Chip Klose does on his Restaurant Strategy podcast.

Want to know:

⭐️ What is the north star in restaurant marketing?

⭐️ What restaurant chains get wrong and what your restaurant can do to beat them?

⭐️ How you can model the tech stack we use at Handcraft Burgers & Brews to take guest orders and drive repeat purchases.

We discuss all this and more on the show.

I'm honored and grateful to have been a part of this conversation!

Watch on YouTube or Listen on Spotify

Thanks!

Rev Ciancio

PS. Are you going to the Restaurant Franchise and Innovation Summit in Coral Gables, FL? We are hosting a food crawl. Hit me up: rev@brandedstrategic.net

That’s it for today! I wish you a wonderful weekend!

See you next week, (about the) same bat-time, same bat-channel.

It takes a village!

Jimmy Frisch & Julia Suchocki

Co-Founder & Managing Partner

Branded Hospitality Ventures

jimmy@brandedstrategic.com

235 Park Ave South, 4th Fl | New York, NY 10003