It’s Not Ideology, It’s Durability & Survival

Friends of Branded!

Happy Saturday and I hope you had a great week.

This week I was pitched by a company that provides fully customizable eco-friendly products and prides itself on a simple mission, make sustainability accessible and cool. Nice!

I was sharing some color from my meeting with a friend and in response he said, “ESG is dead, nobody cares, you should move on.”

First, rude.

Second, ESG is not dead.

I acknowledge that ESG is undergoing a profound and necessary evolution from a buzzword heavy checklist approach, into a more rigorous, data-driven, and integrated business strategy, often called ESG 2.0 (is that really the most creative rebranding folks could up with?). While the acronym faces significant political backlash, the hospitality industry can’t afford to ignore it. For our industry, ESG isn’t a slogan, it’s a scorecard.

Let’s be crystal clear, this isn’t about politics. This is about energy costs, insurance premiums, labor shortages, guest expectations, and capital markets.

ESG (Environmental, Social, Governance) remains highly important to the hospitality industry, and I would argue that its very much a business imperative, not just a “nice to have.”

For the hospitality industry, ESG was never about politics, but rather has always been about:

Utilities

Insurance

Labor

Supply chains

Capital access

Brand equity

Risk mitigation

In other words, it’s always been about math!

Hospitality is a well understood to be an industry with thin margins (unless you’re sitting at Schatzy’s table when he’s ordering the wine) that stands on a foundation of assets, labor, and energy. ESG touches all three.

Let’s breakdown this ESG acronym.

The “E” is for Energy, not Ideology

Hotels and restaurants are energy hogs b/c of the heavy use of heating, ventilation, and air conditioning (aka: “HVAC”), refrigeration, laundry, lighting, and water. Energy efficiency isn’t a social movement. It’s a margin expansion strategy.

Operators that are adopting smart building systems, IoT monitoring, waste reduction, food rescue tech, and supply chain visibility, aren’t doing it to win awards. They’re doing it b/c utilities are rising and waste is expensive.

Reducing landfill? That’s disposal cost control.

Reducing spoilage? That’s cost of goods (“COGS”) protection.

Call it ESG if you want, but I call it operational discipline. Either way, it’s still good business.

The “S” is Labor as in the Real Battlefield

Hospitality is human. Retention, culture, diversity, training, wage structures, these aren’t ESG buzzwords. They’re survival tactics.

You can’t operate a 300-room hotel or a 50-unit restaurant group with disengaged labor (well, actually you can, but you’ll fail, fast).

Brands that invest in workplace culture, career pathing, community engagement, and fair governance aren’t signaling virtue. They’re reducing turnover and let me tell you something Lucy, turnover is expensive.

The “G” is for Governance which is Risk Control

This is the quiet one, but again, governance isn’t political. It’s board structure, internal controls, transparency, compliance, and crisis response.

Bad governance destroys enterprise value faster than a recession.

Just ask anyone who’s lived through a food safety scandal, a harassment lawsuit, a compliance failure, and a supply chain exposure.

Investors don’t price politics. They price risks.

Despite political noise, hospitality operators and investors are tracking energy and water usage more closely than ever. They’re building ESG disclosures into investor decks. They’re negotiating green financing structures, installing tech for real-time monitoring. They’re using traceability platforms to reduce supply risk (please see the Shoutout Section). They’re deploying food donation systems to reduce waste (please see The Deal Room). They’re embedding sustainability clauses into franchise agreements.

Operators are doing all these things b/c lenders, insurers, and institutional capital still care. Global brands still care. Public markets still care. And right up there at the top of the list, guests absolutely care.

And here’s a dirty little secret, capital allocators haven’t abandoned ESG. They’ve just gotten smarter about it and the questions they’re asking are targeted and tactical.

Does this reduce operating volatility?

Does this reduce regulatory risk?

Does this strengthen brand durability?

Does this improve long-term asset value?

That’s not activism. That’s underwriting.

And here is a hospitality truth bomb for you: this industry has always been local, physical, and community anchored.

You operate inside neighborhoods. You hire from neighborhoods. You consume resources in neighborhoods. You can’t “opt out” of environmental and social impact b/c it’s baked into the model.

The big takeaway, ESG isn’t going away, it’s just being reframed and includes less virtue signaling. The focus is on more unit economics and less press releases. The best operators aren’t debating ESG, they’re engineering it into their P&L.

And the smartest investors? They know that long-term hospitality value is built on efficient assets, engaged teams, controlled risks, and transparent governance.

That’s not politics or ideology. That’s durability and survival.

The headlines may debate ESG (which may or may not make for interesting cable news segments), but operators don’t have that luxury. Energy costs are real. Labor turnover is real. Insurance premiums are real. Supply chain risk is real.

Call it ESG. Call it operational discipline. Either way, it hits the P&L.

The hospitality industry isn’t “leaning in” b/c of politics. It’s leaning in b/c durability wins.

Please continue to the Shoutout and The Deal Room sections. This week’s theme continues below.

And finally, before I close out this week’s Top of the Fold, I want to share with the H^2 community that today is my Pop’s birthday! Happy Birthday Dad. I love you like crazy.

It takes a village.

Wake up to better business news

Some business news reads like a lullaby.

Morning Brew is the opposite.

A free daily newsletter that breaks down what’s happening in business and culture — clearly, quickly, and with enough personality to keep things interesting.

Each morning brings a sharp, easy-to-read rundown of what matters, why it matters, and what it means to you. Plus, there’s daily brain games everyone’s playing.

Business news, minus the snooze. Read by over 4 million people every morning.

Danielle Parra, Chief Brand Officer of McAlister’s Deli, joins the conversation to unpack what it takes to grow (and sustain!) a billion-dollar fast-casual brand with more than 500 locations nationwide. From pioneering data-driven loyalty programs to rolling out buzz-worthy, pickle-powered limited-time offers, Parra shares how guest-first thinking fuels real, measurable growth.

Daily news for curious minds.

Be the smartest person in the room. 1440 navigates 100+ sources to deliver a comprehensive, unbiased news roundup — politics, business, culture, and more — in a quick, 5-minute read. Completely free, completely factual.

The Shoutout this week goes to friends at Starfish who continues to be so active, that they may hold the high watermark for most appearances in the Shoutout section (that earns them Branded baseball hats for the entire team, shipping and handling not included)! 😊

This week I want to share that Starfish and ConnectedFresh are teaming up to eliminate one of the food industry’s biggest invisible drag, data silos in the supply chain. By folding real-time IoT condition data into Starfish’s traceability network, food companies can finally see what’s happening, where it’s happening, and why it matters, all without ripping out existing infrastructure.

You can read the partnership announcement here: Starfish and ConnectedFresh Announce Strategic Partnership to Expand End-to-End Supply Chain Visibility

For operators, this means no more blind spots between temperature, humidity, equipment status, and broader supply chain data. You get actionable visibility without rebooting your stack.

For investors, it’s a classic ResTech play where you want to cut friction; unify data; reduce risk; and turn compliance headaches into operational insight.

That’s infrastructure worth backing.

Food safety, compliance readiness, and resilience aren’t just boxes to check, they’re competitive differentiators. And this partnership finally stitches the real-time signals and the traceability fabric into one transparent, proactive system.

Visibility isn’t a luxury. It’s table stakes.

And now, the industry can see the whole board.

Will Your Retirement Income Last?

A successful retirement can depend on having a clear plan. Fisher Investments’ The Definitive Guide to Retirement Income can help you calculate your future costs and structure your portfolio to meet your needs. Get the insights you need to help build a durable income strategy for the long term.

🍸 Your martini order (specifically: how many olives you like in your drink) may be revealing more than you think.

🏠 Inside the private world of Cary Grant: Architectural Digest takes us through 15 intimate photos charting the Hollywood icon’s homes.

🎲 Before parlays went digital and odds lived in your pocket, there were handwritten ledgers and smoky back rooms. The New Yorker revisits the early days of sports betting through memoirs.

🥃 Shopping for something special? These are the 10 best añejo tequilas to buy right now.

💪 The man behind David Protein Bars is selling more than snacks: Peter Rahal's CrossFit-fueled, lifestyle-driven brand has sparked both buzz and lawsuits since first launching in 2024.

❄️ Winter isn’t just for hibernating: apparently, it’s peak season for major cosmetic procedures.

The Deal Room this week brings together a TRIFECTA of some of my favorite companies; Cali BBQ Media and its Restaurant Technology Substack; Jose Andres Group and Copia.

Shawn Walchef, one of the hospitality industry’s leading storytellers traveled to NYC to see how the Jose Andres Group uses Copia technology to put Michelin quality food in hungry hands.

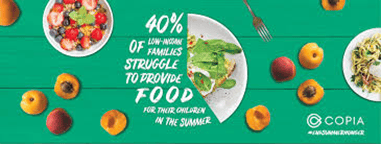

There are few things in our industry more absurd that this: the US throws away over 60 million tons of food annually, while millions of Americans remain food insecure.

America doesn’t have a food shortage issue or a supply problem. We have a logistics and systems problem. That’s where Copia, a technology platform that automates food redistribution to solve the logistics of hunger, comes in.

This collaboration between Jose Andres Group and Copia, has led to JAG becoming the gold standard when it comes to food donations b/c they have made it operationally efficient and seamless to turn what was once a wasted commodity into a valuable asset.

Shawn is an elite storyteller (while I’m a long storyteller) and in the link below, you’ll hear the story of how JAG’s Mercato transforms a once burdensome task into a seamless daily habit.

You can checkout out Shawn’s story here: Feeding People, Not Landfills with Food Donation Technology.

For operators, let’s be clear, most want to donate food. But hospitality runs on velocity and if something is slow, unreliable or interrupts service, it dies. Copia solves the one thing that kills donation programs: operational inefficiency.

If José Andrés Group, operating at Michelin-level standards and serious volume, can institutionalize surplus donation into daily workflow…then let’s face it, so can a 3-unit operator in Dallas, or a 200-unit QSR brand in the Midwest.

This isn’t charity bolted onto operations. It’s operational design.

For investors, this is where impact meets infrastructure.

Copia isn’t a “feel good” app, its logistics orchestration, demand matching, driver dispatch, compliance tracking, and data capture.

It transforms food waste from a cost center into an ESG narrative, community goodwill, tax efficiency, brand equity, and measurable impact.

And in a world where capital is increasingly scrutinizing sustainability and measuring impact, Copia = infrastructure.

The biggest opportunities sit where massive inefficiency exists, where behavior wants change and technology removes friction. Food waste checks all three boxes (another TRIFECTA). 😊

But the most powerful part of Shawn’s story isn’t just the redistribution, it’s the dignity. Michelin-standard paella landing at a shelter doesn’t just feed someone, it restores dignity and humanity.

For hospitality brands, that matters (or at least it should).

Operators, your surplus food isn’t waste, its reputation, community currency, and its alignment with why many founders got into this business in the first place. And let’s face it, if you’re not designing waste out of your system, someone else will.

Investors, the next wave of hospitality tech isn’t about flashy front-of-house widgets, it’s about solving large, invisible inefficiencies.

The best ResTech saves time, preserves margins, reduces friction, strengthens brand equity, and creates a measurable social impact.

Copia sits right at that intersection!

My final thought for this week’s Deal Room, the hospitality industry doesn’t exist to throw things away. It exists to serve.

Technology that aligns operations with mission? That’s the future.

Feeding people instead of landfills isn’t just good optics. It’s operational alignment and nd alignment scales.

To learn about Copia and opportunities to engage as an operator or an investor with this important company, please click here (or contact me directly).

To learn more about Copia and opportunities to engage as an operator or an investor with this important company, please click here (or contact me directly).

You can also click here to share The Deal Room with your network!

(RIP Catherine O’Hara. Your comedy was and still is my favorite form of therapy)

Last week I was at a routine checkup with my neurologist. We were chatting about stress, therapy, life, the usual adulting topics. And then she casually shared that she replaced her therapist with AI therapy. Not only does she prefer it, she called it a game changer.

Let’s pause for dramatic effect.

My neurologist replaced human therapy with AI therapy.

My immediate reaction was that I needed a new doctor… Immediately. I left the appointment unsettled. So naturally, I did what any rational woman does. I went straight to my group chats.

I was not looking for medical advice. I was looking for validation.

But the more we unpacked it, the more the conversation shifted. Not from “Is she crazy?” to “Is she on to something?”

And that’s when it stopped being about my neurologist and started being about restaurants.

Don’t just scroll—click! Congratulate everyone on making the B List and send some LinkedIn love their way.

The Insiders

Build better systems, create effortless impact.

Written by David Meltzer

Fix the right problem before spending.

Written by Rev Ciancio

Devotion is built daily, not measured.

Written by Michael Beck

How to turn kiosks into empowered team assets.

Written by Corey Hines

Design experiences that protect teams and brand.

Written by Melissa Hughes

Build trust, clarity, and accountability for retention.

Written by Jay Ashton

Drive revenue and retention with smart rewards

Written by Rev Ciancio

@schatzyschatzberg POV: Your “3-day pop up” does so well you sign a lease! We hit @theshelf.co@sloanesshelflf to interview founder Sloane about turning buzz ... See more

That’s it for today!

See you next week, same bat-time, same bat-channel.

It takes a village!

Jimmy Frischling

Branded Hospitality

235 Park Ave South, 4th Fl | New York, NY 10003

Branded Hospitality is a foodservice growth platform with three integrated business lines—Ventures, Solutions, and Media. We invest in innovative tech and emerging brands, provide expert advisory and capital strategies, and amplify visibility through podcasts, newsletters, social, and events—creating a powerful flywheel that drives growth, brand strength, and lasting success.

Looking to get in front of 400,000+ hospitality movers and shakers? Dive into our media kit and see how we can help amplify your brand.