As inflation continued to rise through the end of 2022 and into 2023, consumers changed spending habits, including, but not limited to, their eagerness to eat in restaurants. Understandably, seeing prices of classically cheap fast-food increase by a few dollars can be alarming and potentially a real deterrent to the average consumer. Whatever happened to the beloved dollar menu? According to the Bureau of Labor Statistics, quick-service menu prices remain 8.2% higher over last year.

However, as most of our readers can attest to, we love our restaurants and the incredible effort they put into making delicious food. So, this dilemma would seemingly put consumers at a crossroads; spend more money to enjoy the food they love or change spending habits until prices return to normal value?

Instead, consumers found a third option: deal hunting. And no, I don't mean the Walmart mayhem that used to happen on Black Friday, when everything was 70% off. Not to venture off, but what happened to Black Friday? Only 20% really? What a shame.

I'm also not talking about the Grouponners who are only looking for a quick deal. For the Headliners that reside in NYC, you may remember City Crab, a restaurant that used to be where the now famous Union Square Cafe is located. The first time my partner Schatzy used Groupon the restaurant was swarmed with hungry customers looking to spend 25 bucks on all-you-can-eat lobster. Let me tell you, and I can confirm, you can't find a deal like that right now! But not only did those customers not hit the loyalty phase, but they didn't tip well either.

So, let's cut to the chase. I'm talking about the type of deals that get consumers excited about racking up points for a free burrito or coffee.

Data from Circana showed that consumer deal offerings in restaurants grew by 8% year-over year in Q1, despite the fact that April 2023 was one of the slowest food sales months in over a year. While total visits to QSR’s increased by only 2% and full service declined by 1%, deal visits were up by 7% for QSR and 4% for full service.

As guests become harder to attract, restaurants must continue to get creative in their deal offerings, loyalty programs, and digital marketing. It may end up being the difference between the brands that thrive and those that slowly fall behind.

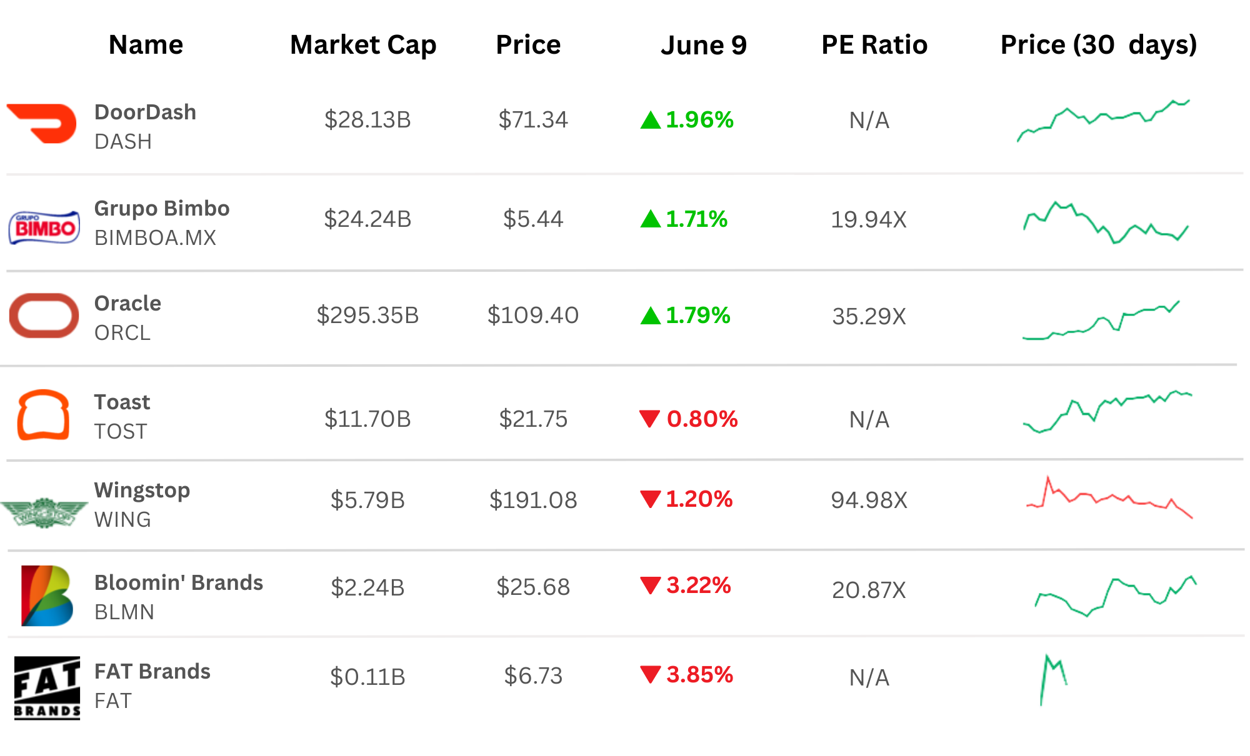

Restaurant Industry Movers in the Market

—Data as of 6/9/2023