Good Morning! Happy Saturday and I hope everyone had a great week!

I want to start this Top of the Fold section off with some commentary on the US equity markets, but I commit that I’ll bring it all back to the foodservice & hospitality industry. Concerns around a recession are most certainly contributing to the overall risk-off environment and an IPO market that has been less than welcoming for the bulk of 2023. Did things change this week?

Where to start: The Michigan Consumer Sentiment Index, a monthly survey of consumer confidence levels in the US with regards to the economy, personal finances, business condition and buying conditions conducted by the University of Michigan, lifted 8% in June, reaching its highest level in four months.

Why the positive sentiment? I believe the increased optimism is the result of inflation easing and policymakers resolving the debt ceiling crisis. According to an article by Jennifer Nash, from VettaFi Advisors, the outlook for the economy surged 28% over the short run and 14%over the long run. Sentiment is now 28% above the historic low from a year ago.

Wall Street and investors seem to be feeling pretty good as the S&P 500 had its 5th consecutive positive week in a row. For some perspective, this is the first such "winning" streak since November 2021 (and the S&P is now up more than 26% from its bear market lows). Not to be outdone, the Nasdaq is now up 8 weeks in a row which reflects its best winning streak since 2019 (and not to be left out, the Dow, it had its 3rd positive week in a row).

Another positive factoid this week was the Federal Reserve delivering on what investors wanted when it left rates unchanged on Wednesday.

In terms of the asset class most associated with the current goldrush, the equity markets remain upbeat or maybe even obsessed with Artificial Intelligence. How obsessed with generative AI do you ask? Great question!

This week Accenture announced it will invest $3bnin AI over the next three years in building out its team of AI professionals and AI-focused solutions for its clients. According to Accenture’s chairwoman and CEO, “there is unprecedented interest in all areas of AI, and the substantial investment we are making in our Data & AI practice will help our clients move from interest to action to value, and in a responsible way with clear business cases.”

The Accenture announcement follows similarly big AI announcements from software leaders such as Salesforce, Oracle and ServiceNow. There’s no indication that such enthusiasm will end any time soon, so equity folks feel these various winning streaks are positioned to continue.

Bringing it all back to the foodservice and hospitality industry (we will ALWAYS bring it back home), the excitement and strong performance in the equity markets was most certainly reflected in Cava's IPO! This Mediterranean restaurant chain was priced at $22 per share and nearly doubled by the end of its first day of trading. The hospitality industry was overwhelmingly joyful of the success of one our own and I’m no exception. I was asked about this IPO from so many friends and peers and these results exceeded all my expectations.

I want to stay positive on this now publicly traded company, but with a day 1 closing valuation of $5bn, it was the 9th largest restaurant group by market cap just behind Wingstop. Cava’s day 1 market cap gave the company a higher valuation than Wendy’s, Shake Shack, Papa John’s, Cracker Barrel and Jack in the Box. Please make of that what you will.

I think it’s important to acknowledge the very favorable backdrop and this well-timed IPO given the momentum in the equity markets and the strong appetite for a restaurant IPO (see what I did there?). When Branded considers making an investment, one factor we weigh heavily is whether the company is one of many, one of a few or the one and only. The more I read about Cava’s IPO, the more this company appears, with its acquisition of Zoes Kitchen, to fall somewhere in the category of one of VERY few.

It wasn’t long ago (Q4 2022) that Yum Brands was out talking about “scanning categories” that don’t compete with its brands (Taco Bell, Pizza Hut, and KFC to name a few). At a JPMorgan conference in Sept 2022, Yum's CFO Chris Turner said, “the Mediterranean-foods space is interesting.” Yum Brands acquisition of Habit Burger Grill in March 2020 helped Yum Brands fill a hole in its portfolio and an acquisition of a Mediterranean brand would do the same.

My point here of course isn’t that I think Yum Brands is going to acquire Cava, but that the category of Mediterranean, at scale, is extremely limited and played a key role in the enthusiasm for this IPO. Brands that offer portfolio diversification and specifically, as veteran industry analyst Mark Kalinowski describes it, a “healthy halo” are important companies to watch. I like Mark’s “healthy halo” as its sound so much better than my own “fake healthy.” I will adopt Mark’s naming convention and as you’ve just witnessed, I will only do so with attribution to Mr. Kalinowski.

At the end of the day, the euphoria of Cava’s IPO will subside (and by that, I mean by next week), and thereafter the company will have to deliver results. As an early-stage investor in privately held companies, the Branded team has substantial experience working with companies that are generating revenues but are still losing money. Since I referenced Wingstop above, this restaurant powerhouse delivered $53mm in earnings last year with an incredibly strong 14.8% net profit margin. Cava, respectfully, lost $59mm. Again, Wingstop is in the category of one of many, while Cava is in the one of VERY few.

At this point, let’s give Cava all the props it deserves for its impressive IPO and its strong first day of trading performance (with a give-back on its second day), but as the IPO celebration comes to end, this story will be all about execution and delivering results. At this valuation, there will need to be some seriously successfully results, but I for one, will be cheering for them.

All the above is certainly reflecting not just signs of life in the equity markets but that a pick-up in activity in the second half of the year looks likely.

As the title of this edition suggests, all is not without material risks and landmines.

The Food-Tech, Hospitality-Tech, ResTech or whatever naming convention you embrace for this emerging asset class, this industry has seen its fair share of booms and busts. Branded’s friends at Restaurant Business and specifically Senior Editor Joe Guszkowski, highlighted three of the industry’s biggest tech suppliers that got smaller this week. Mr. Guszkowski highlighted the splitting of Nextbite and the selling of both parts (Nextbite & Ordermark).

Delivery Services Platform ("DSPs") pioneer, Grubhub laid off 400 people and cited high costs and the need for a new strategy.

And finally, Olo, the online ordering powerhouse to enterprise brands, laid off 81 people as it reorganizes its business.

For avoidance of any doubt, there will be absolutely no throwing of stones whatsoever at these companies. None!

First, Branded loves this industry and believes fully in the digital transformation that is underway and will continue. While Nextbite, Grubhub and Olo are mentioned above, let’s bring one of the “FAANG” companies into the mix and specifically Sundar Pichai, Google’s CEO, who at the start of the year wrote a difficult e-mail to his team of Googlers announcing the layoff of approximately 12,000 positions.

In the letter to the company, he specifically said “over the past two years we’ve seen periods of dramatic growth. To match and fuel that growth, we hired for a different economic reality than the one we face today.” You can read the full letter Mr. Pichai sent out here. By the way, and just for informational purposes, the “FAANG” is comprised of Facebook, Amazon, Apple, Netflix and Google.

My reason for highlighting Google here and its layoffs is to hammer home that building and preparing for growth is a necessary strategy and certainly not a bad thing. Add to that the urging from investors to grow-at-all-costs and a pandemic that made off-premise not only an important segment of the market, but essentially the only game in town for the hospitality industry, and you can see why headcounts expanded so rapidly at the likes of Nextbite, Grubhub and Olo (along with many others).

Markets are volatile and mistakes get made (and please note, I define mistakes as the outcome when one makes (i) the best decision they can, (ii) at the time they need to make it, (iii) with the information they have available, that doesn’t work out). No one intentionally makes bad decisions, but rather the best decisions we can with what we have and when we need to make it.

Layoffs of course suck and losses do as well, but here’s what you need to know – the embracement of restaurant technology & innovation are not only here to stay, but we’re still in the early innings (that's right, despite everything that's gone on in this emerging market, there's still a lot of innovation and growth that needs to be done). A digital transformation of an industry that is the second largest employer in the US doesn’t happen overnight and it doesn’t happen without some trips and falls.

Those that know me, know I pride myself on being a straightshooter and as direct as can be while still always trying to remain professional and respectful. With that disclaimer now in place, let me share an ugly truth, the hospitality industry has a history that was built on the backs of cheap labor. This employment practice was of course not remotely limited to the hospitality industry, but it might have lasted longer in the hospitality industry than others.

Sometimes the truth is not as pretty as we’d like it to be and to quote the legendary Billy Joel, “Cause the good ole days weren’t always good and tomorrow ain’t as bad as it seems.”

Cheap labor is dead! Gone! Finished!

My young daughter will never know the job of a toll-booth collector and I don’t believe that any of my older nieces and nephews know how to keep score in bowling (which is a shame b/c many fun nights of bowling up in Lake George came down to the final frame and therefore the need to understand how to keep score).

Things change and technology & innovation are key factors and a driving force when industries go through transformational periods. The transformation of the hospitality industry will continue and will do so at an accelerated rate. Like the very items that appear on menus that fall in and out of favor (where was avocado toast before the 2010s?), so too will emerging technology & innovation companies (that I can guaranty), but what will absolutely not go out of vogue is the need for operators to embrace the tools that will improve their margins and help champion their pursuit of operational efficiencies. The industry will always look to do a better job taking care of our guests and the tech & innovation that help operators do exactly that will be welcomed, appreciated, and embraced.

The markets are showing signs of life and I dare say resiliency. I’m not aware of an industry that is comprised of a more resilient workforce than the one that comprises the hospitality industry.

Corrections, and periods where capital is scarce, like the one we’re working our way through, are necessary and healthy. I know the people who have lost their jobs or investors that have experienced down-rounds or worse as a result of the embracement or maybe consequences of a “growth at all costs” strategy may not see it that way now. But the industry, and by that, I mean the emerging tech & innovation market that is trying to create value for operators, we’ll see that we’re already coming out better on the other side. None of this is easy and it was never meant to be, but it will be worth it.

One final thing before I close this section out. I want to give a shoutout to Branded’s friends and partners at MarginEdge. This early stage Branded investment was just named by The Washington Post as a Top Place to work for the third year in a row in “medium sized” company category.

There are several honors packed in this recognition. Not only is MarginEdge a Top Place to work, for the third year in a row, but they’ve now been elevated and are listed in the category of midsize companies. These young companies, they grow up so fast, don't they? (especially when led by such extraordinary people as Bo Davis and Roy Phillips). Congratulations Team MarginEdge! We see you and we appreciate you!

We’ve got a lot to cover below, so as always, let’s go!

It takes a village.

QUIZ

Where did the term 86 originate from?

A. It was the radio code used by restaurant staff to alert each other about customers who were behaving inappropriately.

B. It referred to the number of items on an original diner menu, with the last item being crossed out.

C. It originated from the practice of ejecting unruly customers from the Chumley's speakeasy in New York City during Prohibition.

D. It was the designated area for disposing of inedible items at the Union Stock Yards in Chicago.

Answer revealed at the end of the newsletter!

BUSINESS

The Battle of the Kitchen

It wasn't too long ago that third-party delivery was novus, 1995 to be exact. World Wide Waiter was the first online restaurant food delivery service in the world and still operates today as Waiter.com. I can still recall the excitement of being a kid when my dad asked me to order a pizza over the phone. I practiced my order countless times to make sure I got it right. But today, ordering a delicious pizza is as simple as tapping a few buttons on your phone. It magically appears at your doorstep, no interaction required. Talk about serious VIP treatment!

So when the pandemic hit and ghost kitchens became every restaurant's best friend, it's not surprising that entrepreneurs jumped on the concept to get a piece of the pie.

According to a report from Future Market Insights, the takeout market is expected to grow to $4.05 trillion by 2032, almost double the $2.199 trillion reported in 2022. Research by Hospitality Technology estimates the ghost kitchen market was $43.1 billion globally in 2019 and will balloon to $71.4 billion by 2027.

Aside from saving some of our favorite joints, ghost kitchens have proven to provide value in other capacities. They lower overhead costs, offer flexible expansion, and increased efficiency. "Virtually" anyone can open a ghost kitchen and reep the benefits (you see what I did there, a good dad jokes always reels you back in to a fairly debatable concept).

That being said, skepticism lingers in the air, however, Branded remains at the forefront of innovation. While new ideas require refinement, there's always room for effective innovation. The industry is wholeheartedly tackling challenges and striving to provide the ultimate experience for customers and operators. For instance, Uber Eats said that it "will now require ghost kitchen menus to be at least 60% different from any other ghost kitchens operating from that same physical location.” I may be an optimist but I think it sounds like we got something here.

So, as the finance guy, I have to ask; what's the cost? Well if you're a small-scale venture, a single-location storefront will require a substantial upfront investment in real estate, equipment and staffing.

The average cost to open a ghost kitchen is between $20,000 and $60,000, according to Toast’s Restaurant Opening Calculator. The service also estimates the cost of a typical restaurant’s startup costs lying anywhere between $95,000 and $2 million.

Now let's not forget though that we are in the business of hospitality so if you want to offer customers a unique ambiance, social interaction, or an immersive dining experience your GK won't be able to replicate that. However, considering the significantly lower costs and the ability to get up and running within just six months, it's hard to deny the appeal of this venture. It may not offer the same experience, as my operator friends might say, but it's certainly a promising opportunity worth exploring. After all, who can resist the allure of a lucrative and streamlined operation?

TECHNOLOGY

Beware of the fine print - Lease and Location Management Systems are Franchisors Best Friend

Being a mentor and serving on boards of Branded partner companies has given me a front-row seat to witness the amazing evolution of products and the constant need for refinement. As an early-stage investor, I see the relentless hard work required to stay ahead of the game. We always focus on monitoring competitors, embracing new advancements, and listening to customers. However, one aspect that can be easily overlooked is the impact of laws imposed by the big players in the industry. Yep, you always have to keep an eye on the BIG GUY. You don't want to find yourself in a legal pickle!

Let me give you an example: In 2022, a new lease accounting standard was introduced, mandating leaseholders to record most leases on their balance sheets. This meant documenting lease liabilities and corresponding right of use assets. Additionally, lessees had to make changes to their systems and processes. Naturally, this made lease financial reporting more complex, and commercial tenants sought help from CPAs and experts to navigate this new landscape.

Now, I'm no expert but it seems like restauranteurs and franchisors have their work cut out for them with having to store data such as leases, licenses, permits, assets, franchise agreements, contact details, and more.

Luckily, lease accounting software has become so sophisticated that hiring a CPA for $200 or more per hour isn't all too necessary.

Technology, like Branded portfolio company Leasecake, eliminates the need to hire a CPA for high hourly rates. Let's crunch some numbers: Imagine managing 50 leases with an average implementation time of one hour per lease, and monthly reporting time of 15 minutes per lease.

With a CPA, you'd need a total of 50 hours for implementation and 150 hours for annual year-end disclosure reporting, totaling 200 hours. At $200 per hour, that could cost you up to $40,000.

But with Leasecake, the total implementation time is just 5 hours, and you only need 3 hours for annual reporting, making it a total of 8 hours per year. This means this solution can save you up to 45 hours in implementation time, up to 147 hours in annual reporting time, and a total of 192 hours each year.

In the first year alone, you could save up to $37,500, and on an ongoing basis, that's up to $30,000 in savings. Seems like a good deal to me!

As I said, advancement in any company you build is important and in particular new partnerships help startups provide customers with the best possible solutions. Just like Leasecake's recent partnership announcement with David Energy. The partnership is providing clients with improved visibility and control over their operating expenses, including lease and location management as well as streamlined energy operations.

In celebration of their partnership, new customers of each platform will be offered exclusive discounts to the other platform, enabling a synergy between the two offerings via discounts and incentives.

FINANCE & DEALS

The Restaurant Rental Landscape

I may not be in the business of real estate, but I know a good deal when I see one and no I'm not talking about the deals we shell out at our co-working space Bworks. (Shout out to Josh Halpern - our latest Bworks tenant). I'm talking about snagging a great apartment in the peak season in Manhattan (my fellow New Yorkers know what I'm talking about here).

It's great to see that after an unprecedented run over the last two years, apartment renters are about to get some relief. After double-digit percent increases on new lease asking rents last year, tenants can now operate on an even playing field.

The average rental shows new lease asking rents “rose just 2% over the 12 months ending in May”, marking one of the “largest decelerations over any year in history.”

So why is this such a different rental landscape for restaurants? 54% of small business owners say they are paying more for rent now than they did six months ago, a new record for this data since it started being collected from 4,500 respondents since the beginning of the pandemic, according to data collected form Alignable. In the most extreme cases, 14% of small businesses say their rent has jumped by over 20% since December.

The continual increase has been problematic for restaurant owners. In April 2023, 49% of small restaurant businesses were unable to pay rent, a 15% increase from the prior month. That number has continued to increase throughout the year, at only 38% in January. Unfortunately, high inflation continues to hurt restaurants, with 54% of business owners citing high inflation as their top concern, according to U.S. Chamber of Commerce Small Business Index.

And yet, business owners continue to be optimistic. Branded’s thesis continues to be investing in technology that improves business operations, is to the benefit of operators, and hopefully makes money for investors. According to Sharon Miller, resident of Small Business and head of Specialty Banking and Lending at Bank of America, new technologies created to “retain and attract talent, and exploring new tools including artificial intelligence, to gain an edge in a highly competitive market makes small businesses poised for growth.” (NRN)

Despite a global pandemic, high inflation, and limited labor, just like Paul McCartney touring at age 80, restaurants find a way to remain resilient and keep coming back. 76% of small business owners say they are confident their business could withstand economic downturn, while 65% of business owners anticipate revenue growth in the next 12 months. (NRN) Small business owners, and specifically restaurant owners, tend to thrive and innovate in the face of hardship. It just may take some time to have them playing on the same field as the average renter – And new technology will certainly have a word.

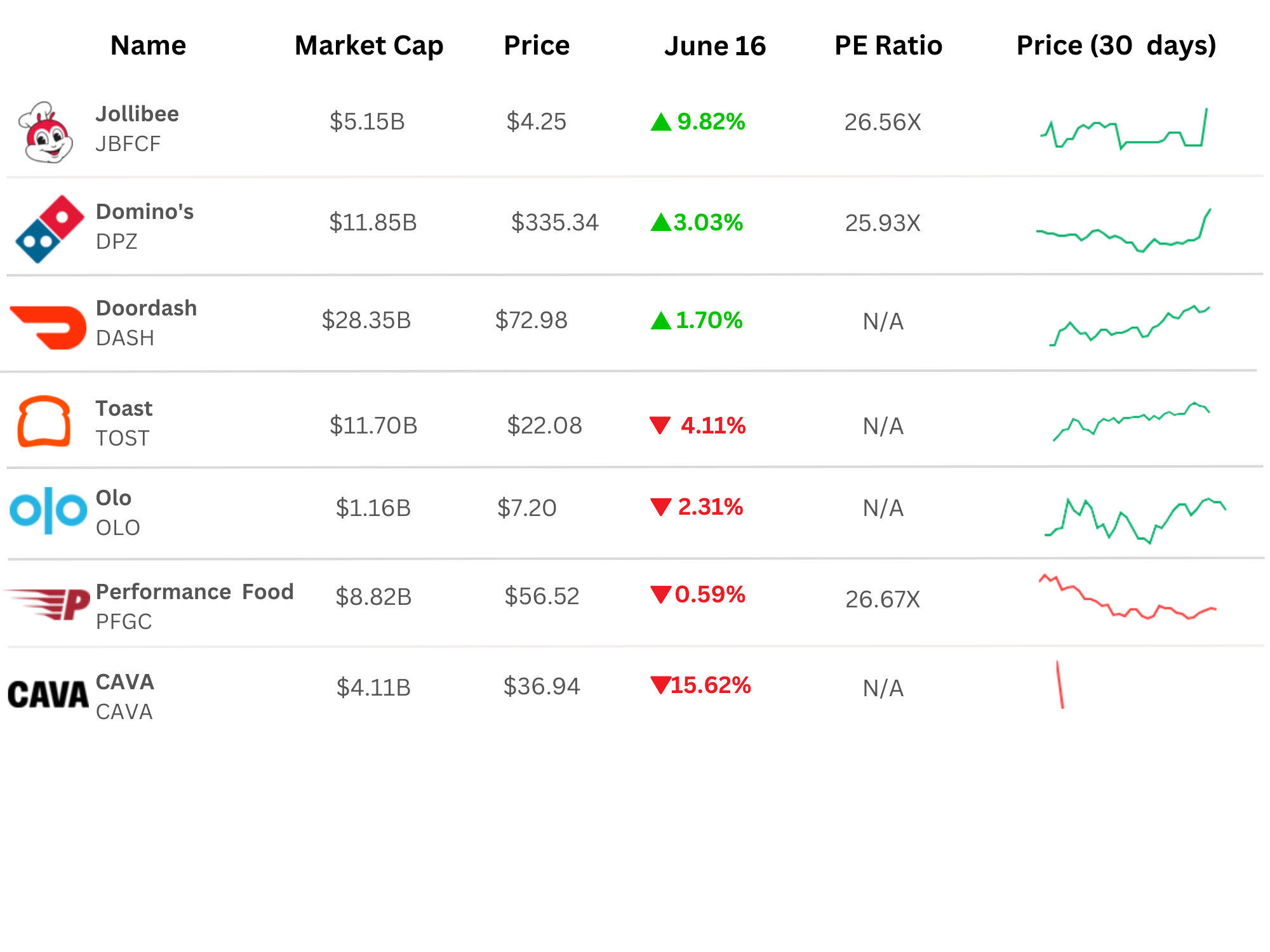

Restaurant Industry Movers in the Market

—Data as of 6/16/2023

PODCAST

Hospitality Hangout

In the latest episode of Hospitality Hangout, hosts Michael Schatzberg “The Restaurant Guy” and Jimmy Frischling “The Finance Guy” sit down with Sherif Mityas, CEO of BRIX Holdings. BRIX Holdings is a Dallas-based franchising company that specializes in superior foodservice chains within the better-for-you segments. Their mission is to provide exceptional franchise opportunities and focus on brands that appeal to the expanding single-unit owner/operator franchise market, with the potential to become national and international award-winning chains. The current BRIX Holdings portfolio includes renowned brands such as Red Mango Yogurt Café Smoothie & Juice Bar, Smoothie Factory Juice Bar, Souper Salad, Orange Leaf, Humble Donut Co., Greenz, and Friendly’s.

Listen on: Spotify, Google Podcast, Apple Podcasts, or Amazon Music

MARKETING

Get Your Emails Seen by More Guests in Just 3 Taps

A few of the Branded team members got to spend some time at the QSR Summit earlier this week. Lots of great conversations happen with tactics, best practices and playbooks shared on how to be successful in the restaurant business.

Not a surprise, email was the answer to the question on the best way to drive frequency and return trips. Your guests may have app notifications turned off, Instagram only shows your content to a small portion of your followers and your store front may not be in their daily travel path. Email is the most affordable and scalable way to get key messages in front of your guests.

But what if your open rate isn't so hot? How do you know if you are even getting into their main email box!??

✉️ Want to increase the reach and open rate of your emails to restaurant guests? Bet you didn't know this hack!

If you're using Mailchimp, there is a secret feature that allows you to resend emails to guests who did not open with just 3 quick taps of your thumb?

Want to know how? Read this!

Do you have an email marketing growth hack to share? Please share: rev@brandedstrategic.net

PS More takeaways from the QSR Summit here.

WHAT DOES REV DO?

*I help restaurants to build guest marketing programs.

*I help hospitality tech companies with lead generation and content marketing.

Need help?

Rev Ciancio

Branded Strategic, Head of Revenue Marketing

IN THE NEWS

We love to highlight Food Service & Hospitality news, especially when it’s Partners & Friends making it!

- Chowly: Why tech efficiency is the biggest challenge for emerging restaurant operators today

- GoTab: Webinar – Top Themes from CBC 2023

- Humanly.IO: Empowering the Future of Hiring: Humanly Raises $12M Series A to Fuel Innovation and Growth

- Incentivio: Understanding the digital restaurant guest journey

- Leasecake: Leasecake and David Energy Partner to Offer Full-Stack Visibility Into Your Operating Expense

- LuckyDiem: What Are Card-Linked Offers? And Why Should Brands be Using Them?

- MarginEdge: Announcing The Washington Post’s 2023 Top Workplaces in the DC area

- Meez: Kiki Araneta on the Truths Behind Hawaiian Food

- Mighty Quinn’s: Mighty Quinn’s brings quality-smoked meats to the Northeast

- Ovation: A Slice of Pizza Industry Expertise With Nick Bobacs

- PourMyBeer: Effective Strategies for Managing Beverage Inventory for Venue Owners

- Valyant AI: Popular Fast Food Franchise Is Replacing Workers With AI

- VROMO: Choosing the right restaurant delivery management software

And in other News…please see some of the stories that caught our attention and that we’re paying attention to. This week was loaded with headlines and news!!

- Meat + Poultry: Nestle working with venture capital fund to promote ag startups

- Bloomberg: Americans Are Eating Out More as the Covid Home Cooking Boom Fades

- Forbes: Stocks Looking To Keep The Party Going

- Nation's Restaurant News: Dog Haus is primed for growth with a diverse portfolio

- Reuters: Uber to cease food delivery in Italy, exit Israel

- VentureBeat: McKinsey report finds generative AI could add up to $4.4 trillion a year to the global economy

- RestaurantDive: BurgerFi appoints former Wall Street analyst as CFO

- PYMNTS: FedNow’s Rollout Will Spur ‘Major Shift’ for Businesses and Digital Wallets, Says Trustly

- TechCrunch: Nobody is happy with NYC’s $18 delivery worker minimum wage

Answer: It was the designated area for disposing of inedible items at the Union Stock Yards in Chicago

That’s it for today!

See you next week, (about the) same bat-time, same bat-channel.