Friends of Branded!

Happy Saturday and I hope everyone had a great week and is enjoying the holiday season.

This is (obviously) the last Saturday of 2023 and that means this is the final edition of the H^2 of the year.

I’ve been working hard to shorten this Top of the Fold section and for those counting words, I’ve cut almost 50% off this section. I’ve previously referenced Mark Twain when came to the length of the Top of the Fold section: “I didn't have time to write a short letter, so I wrote a long one instead.”

As I geared-up and prepared for this final Top of the Fold section for the year, so many ideas, thoughts and themes came to mind. As I white boarded the structure and ways I would attack this section this week, I realized I was setting myself for a big failure with this final installment as opposed to a big win.

The H^2 will continue to roll next week and I aspire for our newsletter to do that in the spirit of the Baltimore Ravens (the hottest team in the NFL right now).

As an early-stage investor in emerging technology, innovation and now restaurant brands in the hospitality industry, I embrace that I'm a risk-taker and I make bets. Readers of the H^2 know that I don’t shy away from the word “bets” b/c when you’re investing in early-stage companies, more than anything else, you’re investing in people and that the leaders of these emerging companies will have the right product, market, fit to deliver value to their targeted audience and win business.

I’m not a wallflower or one that is afraid of giving opinions or offering ideas. I do try to qualify these opinions by the conviction in which I hold them and if I have no opinion (although that would be rare), I’ll make that clear as well.

So, as we bring 2023 to a close, I’d like to use this week’s Top of the Fold section to offer up a few opinions and I dare say predictions for the year ahead. This way, anyone, including myself, can look back and assess the soundness and validity of these opinions.

Hindsight has 20/20 vision, and when we all look back on 2024, the events that unfolded will come with perfect understanding and clarity. Today, things aren’t so clear and to a certain extent, that’s what makes 2024 so exciting to me and Branded’s investment business.

There’s been exhaustive writings about the precipitous fall in capital flows and specifically in VC funding in the technology space over the past 12 to 15 months.

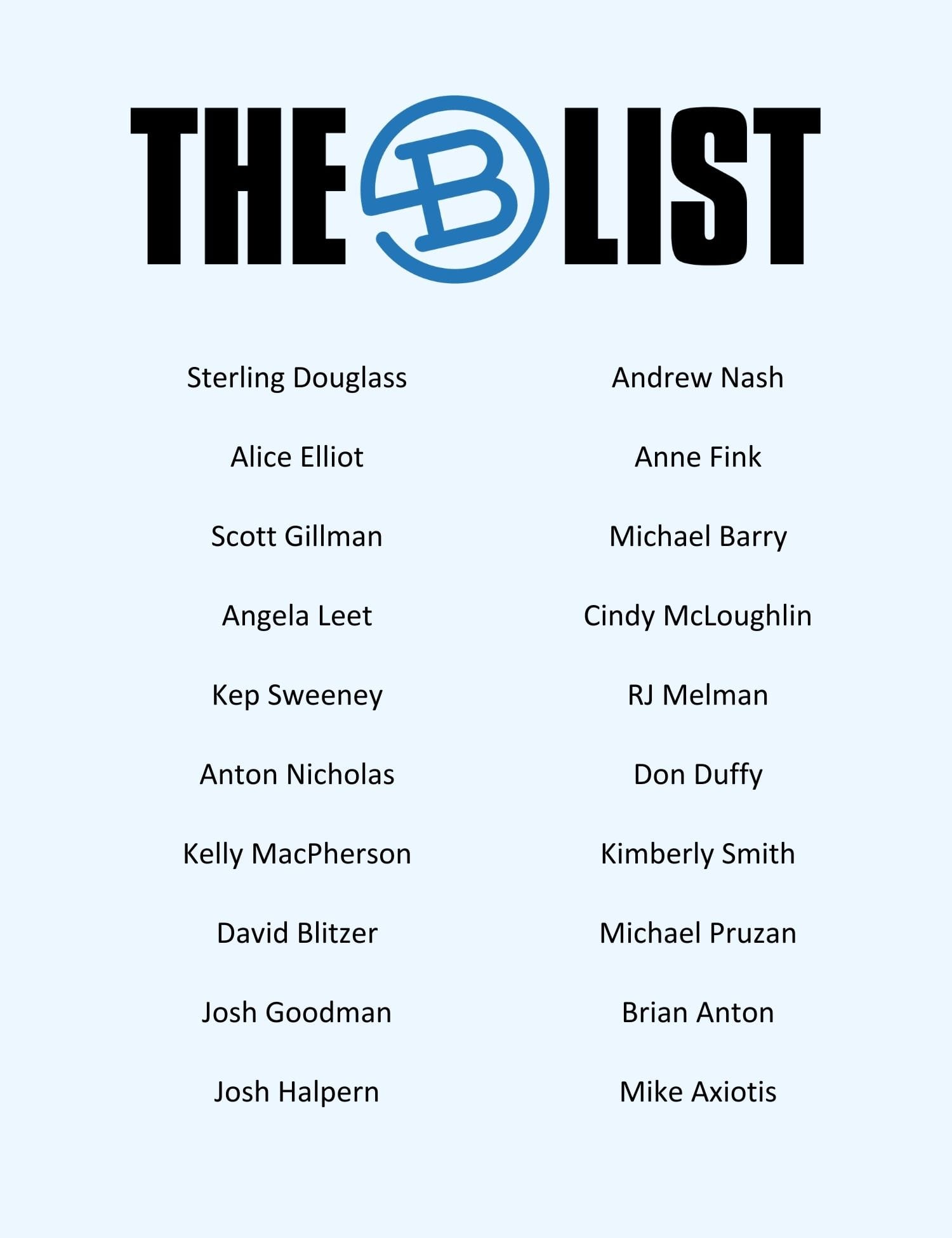

Despite this most challenging environment, Branded had 14 portfolio companies successfully tap the capital markets in 2023 and 11 of them did so with up-rounds. None of these companies benefited from multiple appreciation, in fact, multiples in the technology space are down across the board.

Branded's portfolio companies found success and investors b/c of their respective sales growth. Money can solve a great deal of issues, but it doesn’t solve sales. You either have a company that is delivering value for your targeted customer base, or you don’t.

If you don’t, your lack of sales growth will make that clear and the market has little-to-no patience for companies looking for its product, market, fit and asking (again) for additional capital. The opposite is also true for companies that are seeing sales growth. There is capital available for companies that are seeing sales growth and that’s one of my favorite takeaways from Branded’s portfolio performance in 2023 and what I’m most excited about in 2024.

I’ve said the following before and I will say it again here, loud & proud - 2024 will see a meaningful spike in M&A activity in the foodservice and hospitality tech & innovation industry.

In the spirit of the legendary rock band The Kinks and their 1981 album “Give the People What They Want,” in the world of FoodTech and ResTech, the most important people are the operators. What the people (operators) want is for the number of ISVs (independent software vendors) they’re working with to be reduced (and ideally reduced dramatically). They’d love a one-stop shop, but such a dynamic in the fragmented and diverse hospitality industry makes that all but impossible. However, that doesn’t mean that a consolidation won’t be a key theme for 2024 and Branded is betting on that.

The M&A activity I expect to see will be with the goal of companies looking to create best in suite which is far more desired by operators than best in class. Best in suite will reduce the number of ISV that operators need to engage with and that is without question what Branded's Hospitality Network is telling us they want and I dare say need.

With no disrespect to VCs or investors that are generalists, it is my growing conviction that specialization and specifically strategic investors will rule the day in 2024. Is that a self-serving or self-interested prediction? Yes, of course it is, but this is also something that I saw brewing and gaining momentum in the second half of 2023 and is a trend that is only getting stronger.

Emerging companies, in so many sectors, desire strategic and specialized investors, but this is exponentially true in industries that are incredibly fragmented, such as the hospitality industry. Emerging companies in fragmented industries need more than just capital from its investors. I’ve written plenty about the role of strategic investors and specialists as being the most value-added investors for emerging tech & innovation and that will reach new heights in 2024.

In the hospitality industry, Branded is already seeing large companies that sell into the industry wanting to be more engaged in the emerging tech sector as well as restaurant groups themselves wanting to have greater control over their tech-stack and therefore don’t just want to be customers of these tech platforms, but owners of them as well. Specialization will be an important theme in 2024 b/c of the knowledge of the asset class and network effect that these investors bring to the table.

With respect to alphabet of financing rounds (Angel, Seed, Series Seed, Series A, Series A-1, Series B, etc), I expect a reversion to the mean and a simplification of rounds. This means less “bridge rounds,” “extension rounds,” and other forms of “gap-funding.”

With the frothiness out of the capital markets, companies will need to size their rounds properly and deliver on their roadmaps. Companies will be judged on their ability to meet the expectations they set during the process that raised the capital and the path to profitability will take on greater focus.

Early-stage investors will be less generous and forgiving to companies that miss their own numbers and come back to the well for more capital. These statements should always be in vogue, but when you have strong and performing companies that are successfully moving along their respective maturation curve and priced attractively b/c of lower multiples, early-stage investors will have an array of choices of where to invest their capital. Companies that miss their own projections will find their investors less forgiving and willing to invest additional capital.

And finally (yes, finally), here’s one prediction that is more of a contrarian point of view to what I’ve been reading.

There’s a great deal of hype around the record amount of “dry powder” on the sidelines and waiting to be invested. While I’m not challenging these record numbers (that's just math), I’m NOT prepared to bet that this money must move off the sidelines and be deployed in the venture space.

Yes, I’m seeing a ‘thawing’ in the capital flows and engagement from folks that have been on the sidelines for the past 12 to 15 months, but this capital will not return without being convinced that the companies they’re looking at have a roadmap to profitability. Burn is a 4-letter word and in emerging tech space, it’s become a most ugly 4-letter word. The capital is there, but it does NOT have to come off the sidelines and to the contrary, investors will need to be convinced that the company seeking the capital is deserving and can be trusted with it.

I’m excited about the year ahead. I’m excited about Branded’s newest emerging tech & innovation fund and our first emerging restaurant fund. I’m excited about so many of our portfolio companies that continue to demonstrate value as operator-centric companies that want to optimize margins and create efficiencies for the industry.

I expect Branded will have a number of exits in 2024 as we invested in a number of ‘features’ that are desired by ‘platforms’ seeking to enhance and expand their offering (please see my M&A prediction). I’m excited to be working with a strong and growing group of LPs that are not only investing with Branded, but are engaging with us in a myriad of ways and driving value for themselves and for Branded. I’m also excited for the Branded team and how some of our newer talent is now hitting their own strides, taking on new challenges and building their own place in this industry I love.

2023 was NOT an easy year. It was a challenging one, but things that are truly valuable and have the potential to be amazing are NOT supposed to be easy. We’ve all heard about the importance of enjoying the journey and that includes the good times and the otherwise, he wins as well as the struggles and even the fights.

I hope you all take a moment to reflect on your 2023 and I wish you all good things for 2024! On behalf of Branded and the Hospitality Headline Team, see you next year!

It takes a village.

Readers of the Hospitality Headline, that are interested in learning more about Branded’s portfolio companies, investment strategies and future opportunities, are invited to explore becoming part of our Access Hospitality Network.

Join us for a special edition of Hospitality Hangout as we take a trip down memory lane with a special REWIND episode! Michael Schatzberg “The Restaurant Guy” and Jimmy Frischling “The Finance Guy” chatted with R.J. Melman, President of Lettuce Entertain You, a fifty-one year old restaurant group that is privately held with over one hundred and twenty restaurants across the country in thirteen different states. It is based out of Chicago, Illinois.

You can tune in on Spotify, Apple, Amazon, iHeart, or your favorite listening platform!

This week's winner of the WITW is Branded contest goes to one of our summer interns and a dear friend of Branded, Paloma Fernandez.

Paloma is traveling through the airport in Madrid, Spain with a most special piece of Branded swag.

Safe travels Paloma and we'll see you next year!

Reflecting on a Year of Insights: A 2023 Roundup

As the year draws to a close, the Branded team is excited for this new chapter. We're ready to turn the page to 2024!

In the dynamic landscape of Foodservice and Hospitality, each week has been filled with thought-provoking insights, innovative solutions, and the collective wisdom of our community. This week, instead of providing you with new takeaways, we're taking a step back to curate a special edition that will guide you through the memorable milestones and happenings of 2023.

Thank you for being an integral part of the Hospitality Headline community. Let's take a moment to appreciate how far we've come and eagerly anticipate the promising horizons that await us in 2024.

BUSINESS

TECHNOLOGY

FINANCE & DEALS

MARKETING

ASK THE HEADLINE

🔍 Got Questions? We've Got Answers! 🌟

Satisfy your thirst for knowledge? Look no further! It's time to dive into our brand-new segment: "Ask The Headline"! 🎉

📅 We'll be answering YOUR questions every week. And here's the best part: you can choose to stay anonymous or receive a fabulous shout-out when we feature your question!

That’s it for today!

See you next week, (about the) same bat-time, same bat-channel.

It takes a village!

Jimmy Frisch & Julia Suchocki

Branded Hospitality Ventures

jimmy@brandedstrategic.com & js@brandedstrategic.com

235 Park Ave South, 4th Fl | New York, NY 10003

Branded Hospitality Ventures ("Branded") is an investment and advisory platform at the intersection of food service, technology, innovation and capital. As experienced hospitality owners and operators, Branded brings value to its portfolio companies through investment, strategic counsel, and its deep industry expertise and connections.

Learn more about Branded here: Branded At-A-Glance December 2023